Car Tax Changes 2026: What Drivers Should Know

Introduction — Why car tax changes 2026 matter

Car tax changes 2026 are set to affect both private motorists and business buyers. Changes to federal deductions, shifts in state tax rates and an expanded Section 179 allowance can alter the after‑tax cost of purchasing or financing a vehicle. Understanding these developments is relevant to anyone planning a vehicle purchase in 2025–2026 or preparing tax filings for those years.

Main developments

Federal new‑car loan interest deduction

A recent change in federal law allows taxpayers to deduct up to $10,000 per year in interest on new car loans, subject to qualifying conditions for the vehicle and loan. To claim the deduction the car loan and the vehicle must meet specific requirements; taxpayers should check eligibility before assuming the benefit. For example, a buyer who finances a $35,000 new car and pays $2,800 in interest in 2025 could use this deduction to reduce taxable income if their purchase and loan meet the rules. Lenders such as Scenic Community Credit Union have highlighted the change and are offering guidance and member benefits related to tax filing.

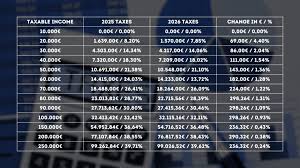

State tax rate adjustments

State‑level tax changes coming into effect on 1 January 2026 will also influence wallets. According to the Tax Foundation, a top marginal rate currently at 5.9% will be reduced to 5.65% in 2026 and further to 5.4% in 2027. These cuts will modestly alter after‑tax income for residents in affected jurisdictions and can affect the net value of vehicle‑related tax benefits.

Section 179 expansion and qualifying vehicles

The One Big Beautiful Bill Act, signed on 4 July 2025, substantially raised the Section 179 deduction limit from $1,160,000 to $2,500,000. This expansion increases the ability of businesses to expense qualifying vehicle purchases in the year of acquisition. Updated Section 179 guidance for 2025–2026 lists over 100 qualifying models, making more commercial and heavy‑use vehicles immediately deductible for eligible taxpayers.

Conclusion — What drivers and businesses should do next

The combined effect of the federal interest deduction, state rate reductions and a larger Section 179 limit could make 2025–2026 an attractive window for purchasing or financing vehicles, particularly for businesses and buyers who meet qualification criteria. Prospective buyers should review eligibility rules, consult a tax adviser and coordinate timing of purchases and financing to maximise benefits. Monitoring guidance from lenders and official tax authorities will be essential to claim savings correctly under the car tax changes 2026.