The Enigmatic Case of Jan Marsalek

Introduction

Jan Marsalek, a former Austrian IT manager and a pivotal figure in the Wirecard scandal, has captivated global media due to his mysterious disappearance. His involvement in financial crimes and connections to espionage have raised questions about accountability and transparency in the financial sector. The ongoing discussions surrounding his case highlight the implications of corporate fraud on international security and trust in financial institutions.

The Rise and Fall of Wirecard

Wirecard, once hailed as Germany’s tech darling, rapidly gained prominence in the FinTech industry. However, this meteoric rise was overshadowed by allegations of financial discrepancies. Marsalek’s role as the COO was crucial; he orchestrated operations that eventually led to a shortfall of 1.9 billion euros in the company’s accounts. After the scandal broke in 2020, Wirecard collapsed, with Marsalek at the centre of a storm marked by accusations of fraud and embezzlement.

The Disappearance

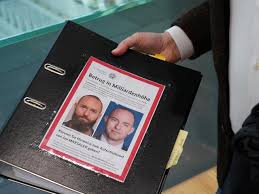

In June 2020, as Wirecard faced insolvency and legal investigations ramped up, Marsalek vanished without a trace. His last known whereabouts were reported in various countries, including Russia and possibly Syria, leading to a multitude of conspiracy theories. Speculation surrounding his disappearance has invoked discussions about his alleged connections with intelligence agencies and organised crime, suggesting that he may have been privy to sensitive information.

International Implications

The case has raised alarms within international law enforcement, with agencies like Interpol involved in the hunt for Marsalek. His disappearance exemplifies broader issues of corporate governance, regulatory failures, and the dark intersections between business and clandestine operations. As investigations continue, the impact of such high-profile fraud cases on investor trust and public faith in the financial markets remains a pressing concern.

Conclusion

Jan Marsalek’s story is multifaceted, intertwining elements of corporate corruption, global intrigue, and the challenges of ensuring accountability in an interconnected world. As authorities pursue leads in various countries, the need for enhanced regulatory frameworks to prevent similar scandals is more pertinent than ever. For readers, the saga of Marsalek serves as a cautionary tale about the complexities of trust in financial ecosystems and the often-unseen consequences of corporate mismanagement on global security.