Understanding the Current Trends in Bitcoin Price

Introduction

The bitcoin price has been a topic of extensive discussion and analysis among investors and traders alike. As the first and most well-known cryptocurrency, bitcoin often sets the tone for the entire digital asset market. Understanding its price dynamics is crucial for anyone looking to navigate the increasingly complex world of cryptocurrency investing.

Recent Trends in Bitcoin Price

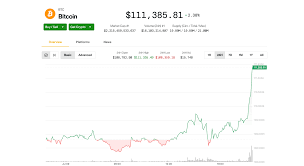

As of late October 2023, the price of bitcoin has recently experienced notable fluctuations. After reaching a high of approximately £40,000 in September, the cryptocurrency has corrected to around £34,000. This volatility can largely be attributed to a variety of factors including macroeconomic conditions, market sentiment, and regulatory news.

Market analysts point to the influence of rising inflation and interest rate hikes as significant contributors to bearish trends observed in recent weeks. Furthermore, concerns about potential regulatory crackdowns in major markets such as the U.S. and EU have added to the uncertainty surrounding bitcoin.

Influencing Factors

One of the most significant factors impacting bitcoin’s price is the demand from institutional investors. According to a recent survey by Fidelity, 86% of institutional investors believe that digital assets will hold long-term value. This opinion has led to increased investments from hedge funds and investment firms attempting to position themselves advantageously in this evolving landscape.

Additionally, the supply dynamics of bitcoin also play a critical role. With only 21 million bitcoins ever to be mined, increasing scarcity – particularly amidst sustained demand – is likely to push prices higher over time. The recent “halving” event, which slashed the rewards for miners, is also expected to limit supply and can lead to price increases in the future.

Conclusion

The bitcoin price remains influenced by a myriad of factors, including market sentiment, regulatory developments, and macroeconomic issues. Investors should remain cautious and informed, utilising both technical analysis and fundamental insights as they engage with this volatile asset class. Forecasts suggest that while short-term fluctuations are expected, long-term investors may still find significant opportunities in the world of bitcoin trading. As always, it’s essential to do thorough research and consider the risks before committing any capital.