CPI Inflation Rate: Current Trends and Implications

Introduction

The Consumer Price Index (CPI) inflation rate is a pivotal economic indicator that reflects the rate at which the prices of consumer goods and services rise over time. Understanding the CPI inflation rate is crucial as it impacts everything from purchasing power to monetary policy decision-making by central banks. As of October 2023, the UK has been grappling with significant inflationary pressures, making it a relevant subject of discussion for both economists and the general public.

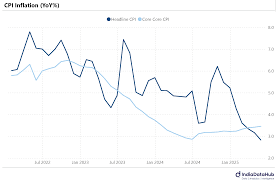

Current CPI Inflation Rate Trends

Recent data from the Office for National Statistics (ONS) shows that the CPI inflation rate in the UK has hovered around 6.5%, down from highs of over 10% earlier this year. This decline signifies a easing, although the rates are still above the Bank of England’s target of 2%. The ONS reported that the main contributors to the current inflation rate include rising costs in housing, household services, and food prices, which continue to pin down consumer spending capacity.

In September 2023, the energy prices saw a decrease compared to the previous months, influenced largely by reduced global oil prices. However, experts caution that energy costs remain volatile and could quickly reverse the trend. Also, the lingering effects of supply chain disruptions that arose during the pandemic still reverberate through various sectors, further complicating the inflation landscape.

Impact on Economic Policies

The Bank of England is closely monitoring these developments as they set interest rates aimed at controlling inflation. With the current rate of 6.5%, policymakers face a delicate balance; they must weigh the risks of slowing economic growth against the necessity of managing inflation to avoid it spiraling out of control. Some analysts predict that interest rates may remain high for a protracted period as the Bank seeks stability in prices.

Conclusion

The CPI inflation rate in the UK remains a critical barometer for the economy, influencing everything from individual purchasing decisions to national monetary policy. With inflation still above target levels, further adjustments may be necessary should the economic indicators suggest a need for a more aggressive stance by the Bank of England. As consumers and businesses adjust to these changes, it is essential to stay informed about the CPI and its implications for financial planning in uncertain times.