Bank of England Base Rate Holds at 4%: What December 2025 May Bring

Understanding the Bank of England Base Rate

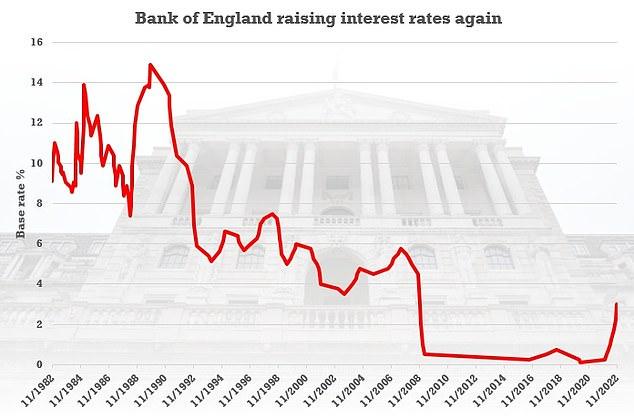

The Bank of England’s current base rate stands at 4%, having been held at this level since August 2025. The base rate is the interest rate the Bank pays to commercial banks and building societies that hold money with it, which influences lending and savings rates across the economy. The Monetary Policy Committee (MPC) meets eight times a year to decide what interest rate is needed to keep inflation at the 2% target.

Recent Rate Decisions and Current Economic Climate

The Bank held the base rate at 4% on 6 November 2025, in what proved to be a closely contested decision. The MPC voted five-to-four in favour of holding rates, reflecting the delicate balance policymakers face. Inflation currently stands at 3.6% as of October 2025, still well above the Bank’s 2% target but showing signs of moderating.

Since August last year, the Bank has been able to cut rates five times, bringing it down from the peak of 5.25% reached in August 2023. The Bank has stated that the risk from greater inflation persistence has become less pronounced recently, and if progress on disinflation continues, Bank Rate is likely to continue on a gradual downward path.

December Meeting and Future Outlook

The MPC will announce its next decision on interest rates on Thursday 18 December 2025. Current market forecasts strongly suggest the Bank will cut interest rates by 25 basis points, reducing them to 3.75%, though experts warn the decision may be more contentious than anticipated.

In holding rates at 4%, the Bank has balanced the risk that above-target inflation becomes more persistent against the risk that demand in the economy is weakening, which might cause inflation to fall too low. Governor Andrew Bailey has indicated that if inflation stays on track, the Bank expects to be able to gradually cut rates further.

Impact on Households and Businesses

The base rate directly affects millions of UK households and businesses. Higher interest rates mean higher payments on mortgages and loans, meaning people must spend more on them and less on other things, while saving becomes more attractive because returns are higher. The December decision will be particularly significant for those on tracker or variable-rate mortgages, who see immediate impacts from rate changes.

As the year draws to a close, all eyes remain on the December meeting, which could set the tone for monetary policy in 2026 and provide much-needed clarity for borrowers and savers alike.