Current Trends of Gold Price in India: An In-Depth Analysis

Introduction

The price of gold in India holds significant importance for investors, jewelers, and consumers alike. India is one of the largest consumers of gold globally, with a rich cultural heritage linked to gold consumption during festivals and weddings. Fluctuations in gold prices can influence local economies, investment strategies, and consumer spending habits.

Current Trends in Gold Prices

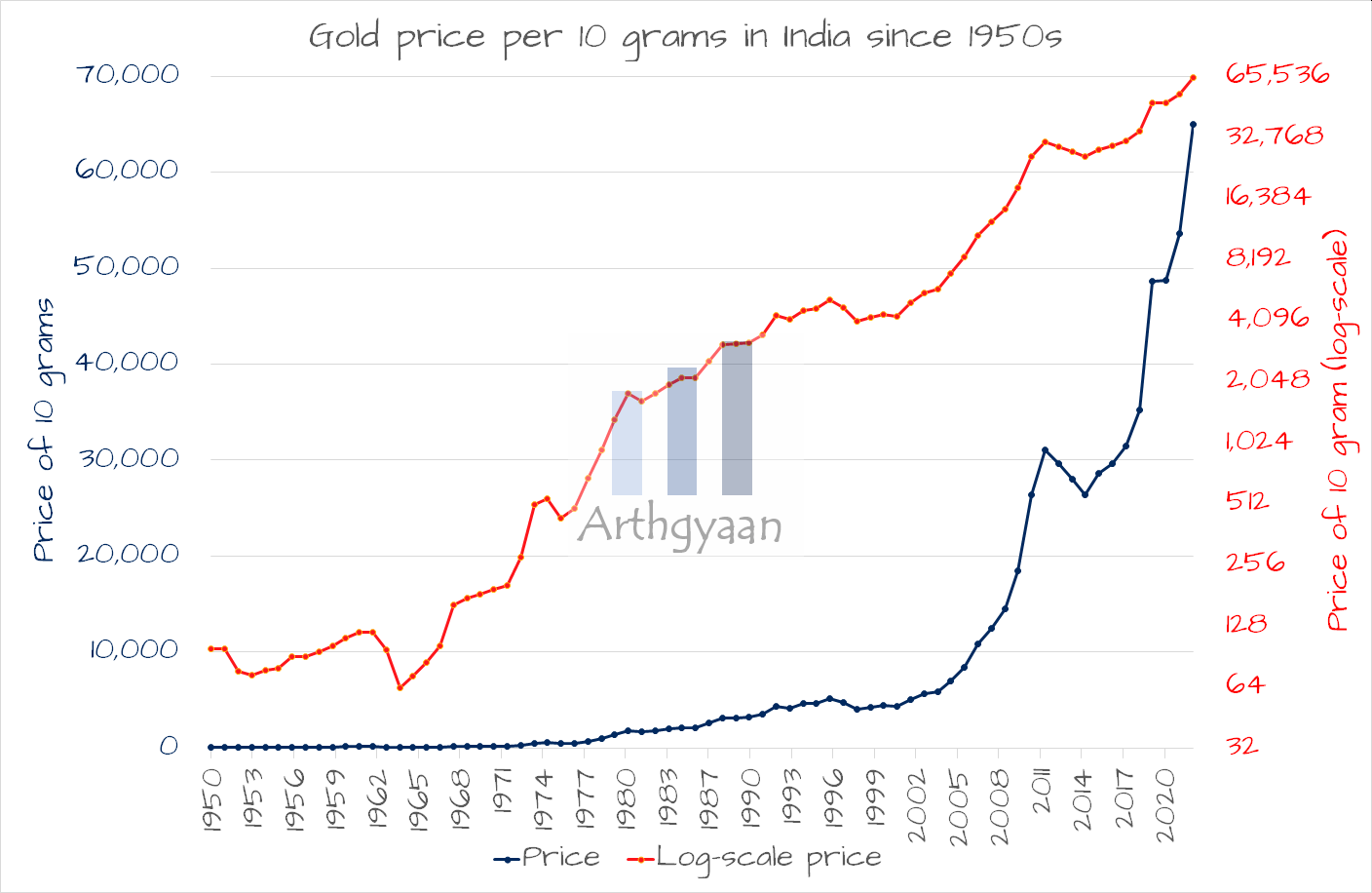

As of late October 2023, the gold price in India stands at approximately ₹58,000 per 10 grams, reflecting a notable increase from earlier in the year. Factors contributing to this surge include global economic uncertainty, inflationary pressures, and geopolitical tensions affecting supply chains. The recent Federal Reserve decisions on interest rates have also played a role, as a lower interest rate typically drives investors towards gold as a safe-haven asset.

Market Analysis

Gold prices in India are driven by both local and international factors. The World Gold Council reports that demand for gold jewelry increased by 60% during the festive season over last year, significantly impacting local prices. Additionally, fluctuations in the value of the Indian Rupee against the US Dollar continue to exert pressure on gold rates. Market analysts predict that if the global economic climate remains volatile, demand for gold might maintain upward pressure on prices.

Impact on Consumers and Investors

The rising cost of gold has impacted purchasing decisions among consumers, particularly during the Diwali festival, which is a peak season for gold buying in India. Investors are advised to consider diversifying their portfolios, with gold being a traditional hedge against inflation. With the price expected to remain high, strategies such as systematic investment plans in gold-related instruments can be beneficial.

Conclusion

In conclusion, the gold price in India is influenced by a myriad of factors, and understanding these will be crucial for consumers and investors alike. As global economic conditions evolve, so too will the demand for gold. Future predictions suggest that prices may continue to rise, making it essential for stakeholders to remain informed about market trends and price forecasts to make sound financial decisions.