The Current State of Government Borrowing in 2023

Introduction to Government Borrowing

Government borrowing is an essential tool for managing a nation’s economy. It allows governments to fund public services, infrastructure projects, and respond to economic crises. As we move through 2023, the importance of understanding government borrowing is heightened, especially in the context of post-pandemic recovery and inflationary pressures. The implications of borrowing levels can affect interest rates, inflation, and overall economic growth, making it a pivotal topic for both policymakers and citizens.

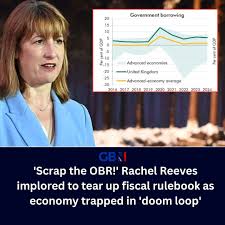

Current Borrowing Levels in the UK

According to the Office for National Statistics (ONS), the UK government’s borrowing for the financial year 2022/2023 reached approximately £140 billion. This figure was slightly lower than the previous year but still contributes to the UK’s substantial national debt, which now stands at over £2.5 trillion. The rise in borrowing can be attributed to increased public spending in the wake of the COVID-19 pandemic and ongoing support for energy costs amid soaring inflation.

Government Strategies and Measures

In 2023, the UK government has implemented several strategies to address its borrowing levels. Chancellor Jeremy Hunt has outlined plans to stabilise public finances while ensuring continued investment in vital public services. A significant aspect of this approach is the commitment to gradually reducing the budget deficit while promoting economic growth through investments in infrastructure and green technology.

Additionally, the Bank of England has hinted at potential interest rate hikes to curb inflation, which could further impact government borrowing costs. As long-term borrowing rates rise, it will be crucial for the government to manage its debt strategically to avoid crippling debt service costs.

Implications for the Future

The future of government borrowing will play a significant role in the UK’s economic landscape. If borrowing is not managed effectively, it could lead to higher interest rates, which would affect everything from personal loans to business investments. Conversely, if handled well, government borrowing could fuel economic growth and recovery, allowing the UK to emerge stronger from the challenges posed by the pandemic and current global economic turbulence.

Conclusion

As 2023 progresses, the discussions surrounding government borrowing will remain vital for understanding the overall health of the UK economy. Citizens and businesses alike should stay informed about borrowing trends and government strategies, as these will undoubtedly influence fiscal policy and economic stability. Balancing borrowing with growth will be the key challenge for policymakers in the coming months, making this topic a significant one to watch closely.