Understanding Fed Rate Cuts and Their Economic Impact

Introduction

The recent discussions surrounding the Federal Reserve’s potential rate cuts have garnered significant attention from economists, investors, and consumers alike. The Fed’s monetary policy decisions, especially regarding interest rates, play a crucial role in shaping economic growth, inflation, and employment levels. As the country grapples with inflationary pressures and economic uncertainties, understanding the significance of these rate cuts becomes imperative for all stakeholders in the economy.

The Current Economic Landscape

As of October 2023, the US economy is experiencing mixed signals with inflation rates hovering around 3.7%, while unemployment remains low at 4.0%. The Fed’s Open Market Committee (FOMC) has taken a cautious approach in its monetary policy, maintaining rates at historically high levels for an extended period to combat inflation. However, recent economic indicators, including slowing consumer spending and manufacturing output, have led to speculation regarding possible interest rate reductions.

Recent Developments

In its latest meeting, the Fed signaled openness to rate cuts if upcoming economic data supports a more dovish stance. Many analysts predict that, barring any unexpected shifts in inflation, the Fed could begin lowering rates as early as the first quarter of 2024. This prospective change in policy is anticipated to provide relief to consumers and businesses, enabling more access to credit and stimulating spending. The stock market has already reacted positively to such expectations, with significant rallies observed in major indices.

Implications of Rate Cuts

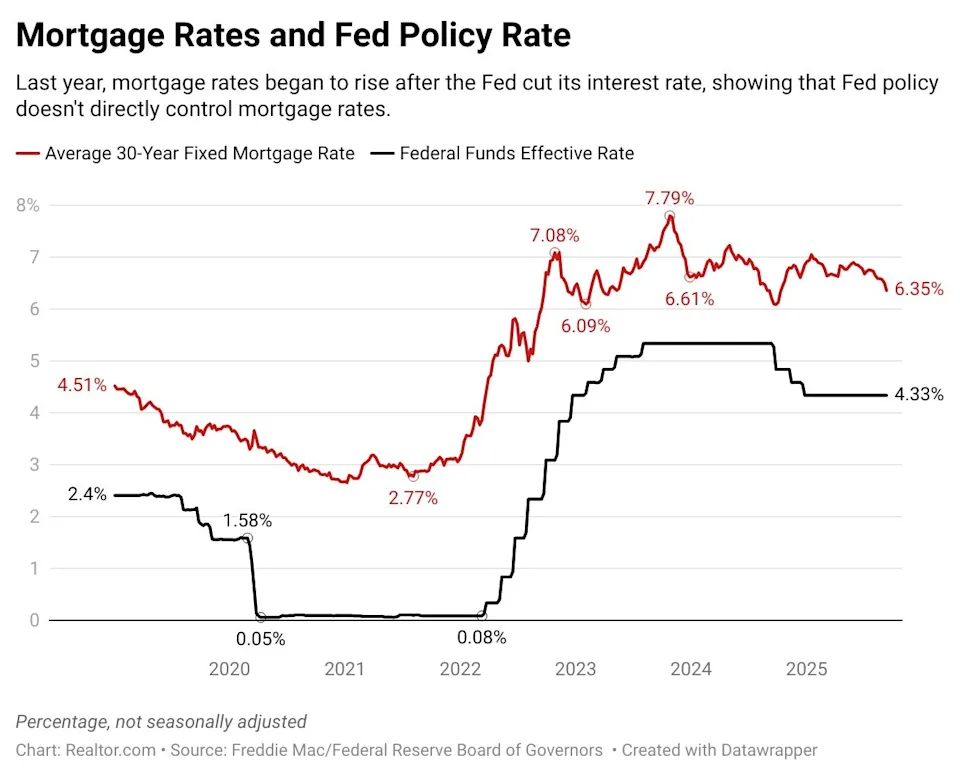

Rate cuts generally aim to lower borrowing costs, thereby encouraging spending and investment. For consumers, this could mean lower mortgage rates and more affordable loans, benefiting sectors such as housing and durable goods. For businesses, it could lead to increased capital investment, fostering further economic growth. However, there are also concerns about the potential risks of cutting rates too soon, including reigniting inflationary pressures.

Conclusion

The possibility of Fed rate cuts has generated a complex narrative about the future of monetary policy and its implications for the economy. As the Fed navigates these challenging waters, stakeholders must remain vigilant, monitoring economic indicators and preparing for the outcomes associated with any shifts in policy. The decisions made by the Fed in the coming months will undoubtedly shape the economic landscape for 2024 and beyond, emphasizing the importance of informed participation in financial decisions.