Latest Insights on Ethereum Price Trends

Introduction

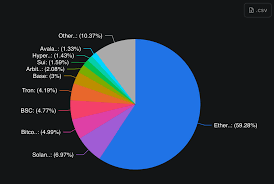

The price of Ethereum, one of the leading cryptocurrencies globally, remains a crucial topic for investors and cryptocurrency enthusiasts alike. With its decentralized finance (DeFi) applications and smart contract capabilities, Ethereum has garnered significant attention. Understanding its current price trends is vital for making informed investment decisions and predicting future movements in the volatile crypto market.

Current Price Overview

As of October 2023, the price of Ethereum is approximately £1,700, reflecting a 15% increase over the past month. This upward trend signals a recovering market after several months of stagnant growth. Recent price movement is attributed to various factors including heightened interest in Ethereum’s upcoming upgrades and broader adoption of blockchain technology.

Factors Influencing Ethereum’s Price

1. Market Sentiment: Positive sentiment surrounding Ethereum has been bolstered by successful integrations of Ethereum-based applications in various sectors, which fosters increased usage and trust in the platform.

2. Technological Upgrades: Ethereum’s transition to Ethereum 2.0 is a pivotal event that has been encouraging investor confidence. The shift from a proof-of-work to proof-of-stake consensus mechanism aims to reduce energy consumption and increase scalability.

3. Institutional Investment: Major financial institutions have begun exploring Ethereum as an asset class for their portfolios, significantly impacting demand and, therefore, its price. Recent reports suggest that institutional investment in Ethereum is expected to increase by 30% by the end of 2023.

Conclusion

The future of Ethereum price remains a subject of great interest. Analysts suggest that if the current trend continues, Ethereum could reach prices of £2,000 or higher by the end of the year. However, potential investors must remain vigilant due to the inherent volatility of cryptocurrency markets. By keeping up with market trends, technological advancements, and institutional buying activity, readers can better position themselves within this dynamic financial landscape.