A Comprehensive Guide to Council Tax in the UK

Introduction

Council tax is a crucial aspect of local government funding in the United Kingdom, significantly affecting residents’ finances and local services. Instituted in 1993, the tax is levied on residential properties, with rates varying based on property value and local authority. Given recent changes and ongoing discussions regarding reforms and affordability, understanding council tax is more important than ever for UK citizens.

Current Regulations and Changes

As of 2023, council tax remains a key source of funding for local councils, supporting essential services such as waste collection, street maintenance, and education. Local authorities assess properties and categorize them into bands from A to H, with Band A being the lowest value and Band H the highest. The government has introduced measures to alleviate financial pressure on residents, particularly in light of the rising cost of living. Some councils have opted to freeze or reduce council tax rates, while others are increasing their rates, significantly impacting residents.

Local Authority Discretion

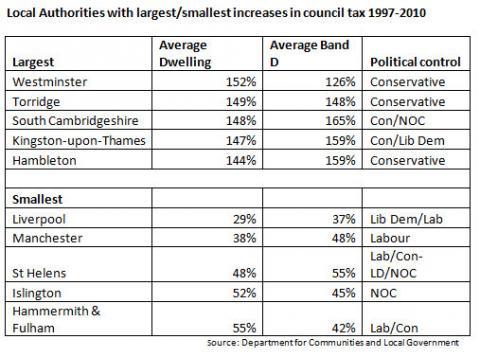

Local councils have a degree of freedom in setting their own rates, which can lead to discrepancies across regions. For example, residents in London typically face higher council tax rates compared to those in rural areas. Additionally, councils have the authority to offer discounts and exemptions for certain groups, such as students, disabled individuals, and low-income households. These variations mean that residents should check their specific local authority’s policies for accurate information.

Impacts of Non-Payment

Failing to pay council tax can lead to serious repercussions, including legal action, court appearances, and potential bailiff intervention. Despite measures in place to help those in financial distress, non-payment can escalate quickly. It is advised that residents facing challenges should communicate with their local council as many offer payment plans and support services to assist vulnerable residents.

Conclusion

In summary, council tax plays a vital role in funding local services but poses challenges for residents due to variability in rates and financial pressures. As local authorities continue to adapt to economic changes, it is crucial for residents to stay informed about their council tax responsibilities and local policies. With ongoing discussions of reform and the importance of community services, council tax remains a topic of significant relevance for households across the UK.