An Overview of American Express and Its Financial Services

Introduction to American Express

American Express, often referred to as Amex, is a global financial services corporation based in New York City. Founded in 1850, the company has evolved from a freight forwarding service to one of the world’s largest card issuers and payment networks. Its significance in the financial sector cannot be overstated, as it offers a wide range of products and services essential for both consumers and businesses.

Current Position and Recent Developments

In recent years, American Express has seen substantial growth, primarily driven by its focus on innovations such as digital payments and customer service enhancements. As of September 2023, the company reported a 15% increase in revenues compared to the same period last year, reaching approximately $13.8 billion. This growth is attributed to a rebound in consumer spending post-pandemic and the increasing adoption of its products.

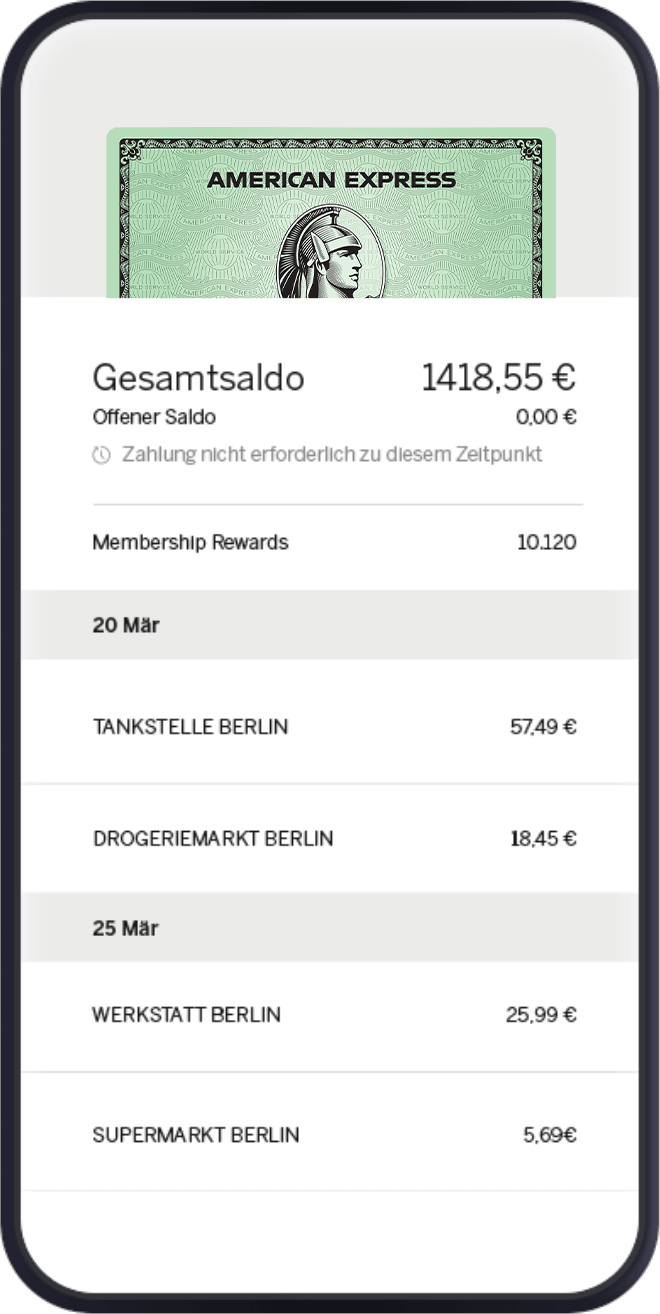

American Express continues to expand its offerings, including the introduction of new credit card features such as enhanced rewards programs that cater to travel and dining enthusiasts. The company’s push into the digital realm has also been significant; its partnership with various fintech companies is aimed at streamlining payment processes and expanding its customer base. Additionally, the launch of its ‘Amex Pay’ feature allows users to make payments seamlessly through digital wallets.

Significance for Businesses and Consumers

For businesses, American Express provides various solutions, including payment processing systems and business loans, which can facilitate growth and enhance cash flow management. The company’s robust customer support system is a notable aspect that differentiates it from competitors. Furthermore, American Express has been recognized for its commitment to financial inclusion, expanding credit access to small businesses and underserved communities.

For consumers, the appeal of American Express lies in its premium rewards, such as travel benefits and exclusive access to events. However, the company remains vigilant in addressing concerns about fees and interest rates associated with its premium cards, ensuring that they provide value to cardholders.

Conclusion and Future Outlook

The future of American Express appears promising as it adapts to changing market conditions and consumer preferences. With an increasing number of transactions shifting towards digital and contactless payments, American Express is well-positioned to enhance its technological capabilities. As the company continues to innovate and expand its reach, consumers and businesses can expect more tailored solutions and improved user experiences.

In summary, American Express not only continues to be a leader in the financial sector but also plays a vital role in shaping the future of payment and financial solutions globally.