Current Trends and Updates on SSE Share Price

Introduction

The share price of SSE plc, a leading UK energy company, is a focal point for investors and market analysts due to its influence on the energy sector and its impact on the UK’s transition to renewable energy. Understanding the fluctuations in SSE’s share price is crucial for investors considering entry or exit points, especially as energy policies and market dynamics evolve.

Recent Developments

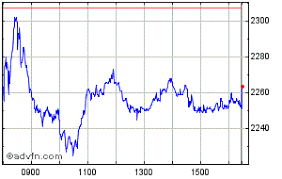

As of October 2023, SSE’s share price has experienced notable volatility influenced by various factors, including energy prices, government regulations, and broader market conditions. Recent reports indicate that SSE’s shares were trading around £19.50 in early October, reflecting a slight increase from the previous month, amid rising energy demand and ongoing investments in renewable projects.

In September 2023, SSE announced significant advancements in its renewable energy portfolio, including the completion of several wind farm projects. This announcement contributed positively to investor sentiment, indicating the company’s commitment to sustainable energy.

Market Influences

The energy sector is currently facing challenges with fluctuating commodity prices and regulatory changes. Analysts have linked the increase in SSE’s share price partly to an uptick in gas and electricity prices set by the UK government in response to inflation and energy stability concerns. Furthermore, global trends for renewable energy investments are gaining traction, positioning SSE firmly within a growing market.

Expert Opinions

Financial analysts remain optimistic about SSE’s long-term outlook. Many suggest that the company’s proactive transition towards sustainable energy sources will bolster its market position. According to a recent analysis by market research firm Aon, SSE is set to outperform the FTSE 100 as more investors pivot towards companies leading the green energy charge. Additionally, the firm forecasts a potential increase in SSE’s share price by approximately 10-15% over the next year, contingent on continued investment in infrastructure and regulatory support for green initiatives.

Conclusion

The SSE share price remains on the radar of investors keen on the energy sector’s shifts. With policies favouring renewable energy, an increasing demand for sustainable practices underlines the potential for further growth in SSE’s valuation. Investors are encouraged to keep abreast of market trends and SSE’s strategic developments to make informed decisions. Given the industry’s direction, SSE’s share performance is likely to provide significant insights into the broader energy market landscape in the UK.