Current Trends in AstraZeneca Share Price

Introduction

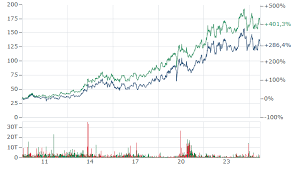

AstraZeneca, a global biopharmaceutical giant, has been in the spotlight recently, particularly with respect to its share price movements. Understanding the factors influencing the AstraZeneca share price is crucial for investors seeking to navigate the volatile landscape of pharmaceuticals and biotechnology. Recent developments in the COVID-19 vaccine space, patent expirations, and ongoing clinical trials are among the key elements driving the company’s stock performance.

Recent Developments Affecting Share Price

As of October 2023, AstraZeneca’s share price has experienced fluctuating trends due to several factors. The company’s focus on innovation and maintaining strong drug pipelines has contributed to investor interest. Recent announcements concerning positive clinical trial results for some of their drugs have led to a brief uptick in share prices, while news about patent expirations on major drug lines has caused significant concern among investors.

The stock has also been influenced by the broader market environment, including inflation rates and interest rates that affect investor sentiment across the healthcare sector. In addition, the ongoing geopolitical tensions and their economic ramifications have added further uncertainty to AstraZeneca’s share performance. Investors are keeping a keen eye on how federal regulations regarding drug pricing and approval might impact future earnings.

Market Analysis and Future Outlook

Financial analysts have provided mixed forecasts regarding the AstraZeneca share price. Some experts project gradual growth based on new drug approvals and successful sales performance in emerging markets. Others caution that any setbacks in clinical trials or external market pressures could adversely impact the stock. Given the unpredictable nature of pharmaceutical development and regulatory hurdles, investors are advised to stay updated on AstraZeneca’s quarterly earnings reports and development updates.

Conclusion

The AstraZeneca share price is a reflection of both the company’s strategic position within the pharmaceutical industry and the current market climate. Investors must assess the potential risks and rewards before making investment decisions. As new data emerges from clinical studies and market evaluations, the AstraZeneca share price will undoubtedly continue to be a point of interest for many. Observing the company’s actions and market reactions will provide essential insights to facilitate informed investment choices.