Current Trends in Gold Rates Today

Introduction

The gold market has always been a focal point for investors, especially during economic fluctuations. Understanding the gold rate today can provide insights into market trends and inflation risks. As of today, 24th October 2023, gold prices have seen notable changes, impacting both investors and consumers alike.

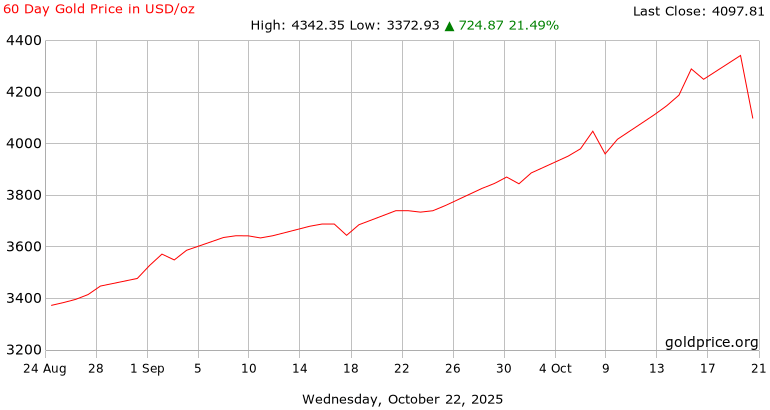

Current Gold Rates

As of today, the price of gold per ounce stands at £1,750, reflecting a slight increase from the previous week’s average of £1,745. This fluctuation has ignited discussions among market analysts regarding the potential for further price changes. The rates for 22-carat gold are currently at £1,586 per ounce, while 18-carat gold can be obtained at around £1,304 per ounce. These prices are subject to market conditions, including demand, currency strength, and geopolitical tensions.

Factors Influencing Gold Prices

Several factors contribute to the current rise in gold prices. One key influence is the ongoing uncertainty in global markets, exacerbated by geopolitical tensions, particularly in Europe and the Middle East. Investors often turn to gold as a safe haven during times of crisis, which increases demand and subsequently drives up prices.

Additionally, recent changes in interest rates also play a significant role. The Bank of England’s decision to maintain lower interest rates in the face of rising inflation has resulted in decreased yields on bonds, making gold more appealing as an investment.

Looking Ahead

Market analysts suggest that gold prices may continue to rise, especially if inflation persists and economic uncertainty remains. Conversely, should the global economy stabilise and interest rates increase, gold may experience a dip as investor confidence shifts back to equities and bonds. Many experts recommend keeping a close watch on economic reports, particularly inflation indicators and central bank meetings, for signs of shifts in gold trading patterns.

Conclusion

The significance of tracking the gold rate today cannot be understated, whether for personal investment or market forecasting. With ongoing economic shifts and global tensions, the gold market will likely remain volatile. For those considering investing in gold, staying informed about current trends and potential market influences is crucial for making well-informed decisions.