Current Trends in Lloyds Share Price

Introduction

The Lloyds share price remains a significant topic for investors and financial analysts alike, especially given the context of an evolving economic landscape. As one of the largest banking and financial services organisations in the UK, fluctuations in Lloyds Banking Group’s share price can offer insights into the overall health of the UK economy, investor confidence, and the banking sector’s stability. The performance of Lloyds share price is closely monitored as it often mirrors broader market trends and investor sentiment.

Recent Performance

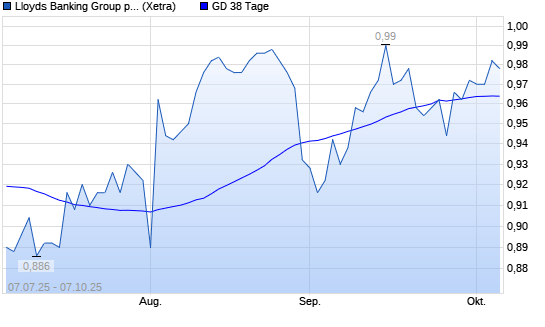

As of the latest financial reports in October 2023, Lloyds share price experienced noteworthy fluctuations, reflecting a mixture of market optimism and investor caution. In September, the shares were trading around £0.50 but saw an uptick to approximately £0.55 following a robust earnings report for Q3, which showed a net profit increase of 10% from the previous quarter. Analysts attributed this growth to a fall in loan defaults and increased net interest income due to the rising interest rates.

However, market volatility remains, particularly amidst concerns over inflation and potential interest rate adjustments by the Bank of England. Investors are keenly watching these indicators, as they can directly impact the profitability of banks including Lloyds.

Market Analysis

The share price of Lloyds is heavily influenced by both domestic and international economic factors. Recent news regarding the UK government’s fiscal policies and economic growth forecasts are adding layers to the decision-making processes of investors. The UK economy’s recovery from the pandemic has been slower than anticipated, raising questions about future performance. Additionally, September’s inflation report showed concerning numbers, which may prompt shifts in the central bank’s monetary policy.

Furthermore, global events, such as geopolitical tensions and energy crises, are also affecting investor confidence. Analysts suggest that for Lloyds to maintain strong share price performance, they must continue to navigate these challenges successfully while capitalising on their market position.

Conclusion

In conclusion, the Lloyds share price is a reflection of both the banking industry’s resilience and the challenges posed by the broader economic environment. As we move towards the end of 2023, investors are advised to stay informed about economic indicators and market trends. Monitoring the Lloyds share price is not just about tracking a stock but understanding the dynamics of the UK economy. As the situation evolves, proactive management and strategic decision-making will be essential for stakeholders looking to benefit from changes in the Lloyds share price.