Current Trends in Rolls Royce Share Price

Introduction

The Rolls Royce share price is a significant indicator not only of the company’s market performance but also of broader trends within the aerospace industry. As one of the leading manufacturers of aircraft engines and power systems, fluctuations in its share value can reflect the company’s financial health and investor sentiment. Recently, the share price has come under scrutiny due to a variety of economic factors, making it crucial for investors to stay informed.

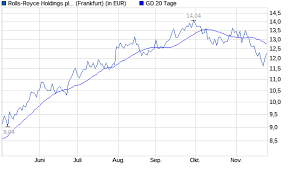

Recent Performance

As of October 2023, Rolls Royce’s share price has experienced notable volatility. In recent weeks, shares have hovered around £1.50 to £1.70, showcasing a gradual recovery from lower points earlier this year that saw prices dip below £1.00. The company attributed this increase to strong demand in the civil aviation sector as travel restrictions ease, leading to more flights and subsequently, higher demands for aircraft engines.

Factors Influencing Share Price

Several factors are currently impacting the Rolls Royce share price. Firstly, the ongoing recovery in global air travel is proving beneficial, with airline orders for new aircraft increasing. According to industry analysts, demand for efficient aircraft engines will likely grow, and Rolls Royce’s innovative technologies position it well to capture this market. Economic indicators, such as inflation rates and fuel costs, also play a crucial role in investor perception and share dynamics.

Moreover, Rolls Royce has made strategic moves in diversifying its business sectors beyond traditional aerospace manufacturing, such as investing in sustainable energy solutions. These initiatives are viewed positively by investors and contribute to a more robust long-term outlook.

Conclusion

In summary, the Rolls Royce share price is experiencing a positive trajectory, buoyed by the recovering aviation sector and the company’s strategic initiatives. Investors are advised to monitor ongoing market trends and company developments, as these will likely dictate future share performance. With improved procurement, financial recovery, and a commitment to innovation, the outlook for Rolls Royce appears promising, but potential investors should remain vigilant about market volatility and economic shifts that could impact overall performance.