Everything You Need to Know About Vehicle Tax in the UK

The Importance of Vehicle Tax

Vehicle tax, often referred to as road tax or car tax, is a crucial aspect of vehicle ownership in the United Kingdom. It plays a significant role in the maintenance and development of the country’s transportation infrastructure. The funds collected from vehicle tax are allocated to improving roads, public transport systems, and overall transport services. Understanding vehicle tax is vital for all car owners, as failure to pay it can result in fines and legal issues.

Current Rates and Regulations

As of October 2023, vehicle tax rates are determined by several factors, including the age of the vehicle, its engine size, and emissions. New vehicles registered from April 2017 onwards are subject to a tax band system where charges can vary substantially based on CO2 emissions. For instance, electric vehicles currently benefit from exemptions, encouraging drivers to opt for greener alternatives. The annual road tax can range from as low as £0 for zero-emission vehicles to upwards of £500 for high-emission vehicles.

Recent Changes and Updates

In recent months, the UK government has announced plans to reform the vehicle tax system to better accommodate the increasing number of electric and hybrid vehicles on the road. With the goal of reducing carbon emissions, these reforms include a consultation process involving stakeholders from various sectors. Additionally, the government aims to phase out petrol and diesel vehicles by 2030, which is expected to have significant implications for future vehicle tax structures.

The Consequences of Non-Payment

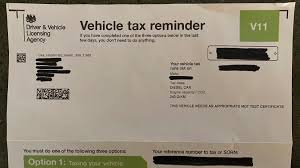

Not paying vehicle tax can lead to severe repercussions for car owners. The Driver and Vehicle Licensing Agency (DVLA) employs automatic number plate recognition technology to identify vehicles that are not taxed. If caught, drivers can face fines of up to £1,000, and the vehicle may also be clamped or impounded. Hence, it is imperative for vehicle owners to stay informed about their tax obligations and ensure timely payments.

Conclusion

Overall, vehicle tax remains a fundamental component of vehicle ownership in the UK. The government’s ongoing reforms are aimed at promoting environmentally friendly transport options and funding essential transport infrastructure projects. For car owners, keeping abreast of changes in vehicle tax legislation can help avoid unnecessary penalties while contributing to the broader goal of sustainability in transportation.