Latest Updates on Lloyds Share Price Performance

Introduction

The performance of Lloyds Banking Group share price is a crucial indicator for investors and the financial market, reflecting both the bank’s operational health and broader economic trends. With the stock market constantly fluctuating, understanding the factors that influence Lloyds share price is essential for both seasoned and new investors looking to make informed decisions.

Current Performance and Market Trends

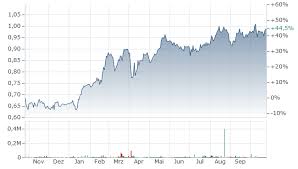

As of October 2023, Lloyds share price has shown a significant increase, trading around £0.54, representing a 4% rise over the past month. Analysts attribute this upward trend to several factors including a more stable economic environment, recent interest rate adjustments, and the ongoing recovery from the pandemic’s impact on the financial sector. The bank’s commitment to returning value to shareholders through dividends also plays a vital role in attracting investor interest.

Recent Financial Reports

In its latest quarterly report, Lloyds reported a net profit increase of 20% year-on-year, buoyed by robust loan growth and a decrease in loan impairment charges. The bank’s provisions for bad loans dropped significantly, suggesting confidence in the economic recovery. Such promising financial results have contributed positively to the Lloyds share price, drawing attention from both retail and institutional investors.

Analysts’ Insights

Market analysts have encouraged investors to keep a close watch on the upcoming economic indicators, particularly the UK’s inflation figures and any changes to the Bank of England’s monetary policy. Some are optimistic that Lloyds’ share price could reach £0.65 in the next quarter if the financial trends continue positively and global economic stability is maintained. However, external factors such as geopolitical tensions and rising operational costs could pose risks to this forecast.

Conclusion

The Lloyds share price presents a compelling opportunity for investment, especially given its recent performance and the promising outlook according to analysts. For investors, keeping abreast of market trends and financial indicators will be crucial in making timely decisions regarding their holdings in Lloyds Banking Group. Overall, as the financial landscape evolves, Lloyds continues to play a significant role, making its share price a key point of interest for financial markets.