The Essential Role of Mortgage Brokers in the Current Market

Introduction

As the UK housing market continues to evolve, the role of mortgage brokers has become increasingly significant. With fluctuating interest rates and various lending options available, prospective buyers are often overwhelmed by the mortgage process. Mortgage brokers serve as vital intermediaries, guiding clients through this intricate landscape to secure the most suitable financing options to meet their needs.

Current Mortgage Market Overview

The 2023 mortgage market is marked by a mix of challenges and opportunities. Following the economic impacts caused by the COVID-19 pandemic and subsequent geopolitical events, interest rates have seen substantial fluctuations. According to the Bank of England, the average interest rate for a two-year fixed mortgage reached 4.14% in September 2023, compared to 3.36% a year prior. This rise in rates has made assessing mortgage options more complex.

The Role of Mortgage Brokers

Mortgage brokers are licensed professionals who act as intermediaries between borrowers and lenders. They offer various services, including assessing a client’s financial situation, offering tailored mortgage advice, and helping with paperwork. Notably, around 75% of UK homebuyers are using brokers to find the best deals, according to recent research from London-based financial advisory firm, Moneyfacts.

One of the primary advantages of working with a mortgage broker is their access to a wide range of lenders, some of which may not directly engage with the public. This allows clients to explore options that may fit their unique financial situations even better.

Challenges Faced by Brokers

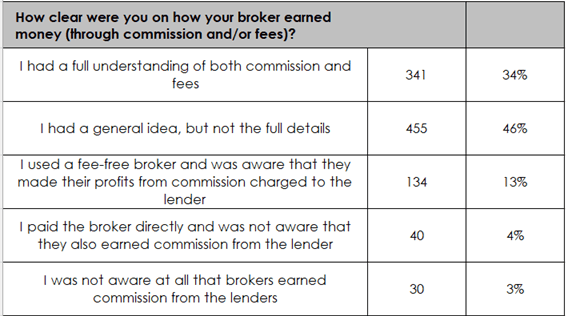

Despite their advantages, mortgage brokers face several challenges in 2023. The changing economic climate has led to tighter lending criteria from traditional banks, making it difficult for some buyers to secure loans. Brokers must stay current with these changes and adapt their strategies accordingly. Additionally, the recently implemented regulatory changes require brokers to enhance transparency in their fee structures, further complicated their operations.

Conclusion

As the mortgage landscape continues to shift, the importance of mortgage brokers in the UK cannot be understated. They play an essential role in navigating the complexities of obtaining a mortgage while providing peace of mind to clients. With ongoing economic changes expected in the coming years, the demand for knowledgeable and adaptable mortgage brokers is likely to grow. Prospective homebuyers would be wise to consider these professionals as valuable allies in achieving their home ownership dreams.