The Importance of Lifetime ISA for Saving and Investing

Introduction to Lifetime ISA

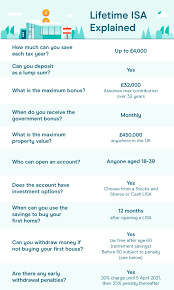

The Lifetime Individual Savings Account (ISA) has rapidly gained traction since its introduction in 2017, offering individuals aged 18 to 39 a unique opportunity to save for their first home or retirement. With an attractive government bonus of 25% on contributions, it has become an essential financial tool for young savers in the UK. Understanding the features and benefits of a Lifetime ISA is crucial for anyone seeking to maximize their savings and investments.

How Lifetime ISA Works

A Lifetime ISA allows individuals to save up to £4,000 each tax year, with the government adding an additional £1,000 as a bonus for those who contribute the full amount. This bonus can be a significant boost for young adults aiming to buy their first property or those beginning to plan for retirement.

The funds in a Lifetime ISA can be withdrawn tax-free when used for purchasing a first home, provided that the property is valued at up to £450,000. Furthermore, after the age of 60, individuals can access their savings without any penalties for retirement purposes. If the funds are accessed for any reason other than the specified purposes, a penalty of 25% will apply on the amount withdrawn, which effectively negates the benefit of the initial government bonus.

Recent Trends and Statistics

According to recent statistics from HM Revenue and Customs (HMRC), over 500,000 Lifetime ISAs were opened by the end of 2022, with contributions exceeding £1.3 billion. This growth reflects a rising consciousness among younger individuals regarding the importance of financial planning and investments. The recent monetary policies and housing market fluctuations have also influenced the interest in Lifetime ISAs as individuals seek stable options amidst economic uncertainty.

Conclusion and Future Outlook

The Lifetime ISA presents a valuable opportunity for young adults to cultivate their savings and navigate their financial futures. As the UK economy evolves, the features of the Lifetime ISA may adapt. However, its core advantages of government-backed bonuses and tax-free withdrawals for specific purposes will likely continue to make it a sought-after product for first-time homebuyers and retirement savers alike. With increasing awareness and accessibility, the Lifetime ISA will remain a vital component in the financial toolkit of young savers, providing them with the means to achieve their long-term goals.