The Importance of Your Credit Score Explained

Introduction

In today’s financial landscape, a credit score is more than just a number; it is a vital component of your financial health. A credit score can influence your ability to secure loans, mortgages, or even rental agreements. Understanding this score and its implications has thus become more crucial for individuals looking to achieve their financial goals.

What is a Credit Score?

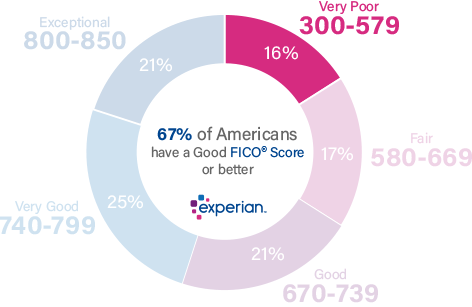

A credit score is a numerical expression of a person’s creditworthiness, calculated based on their credit history. It typically ranges from 300 to 850, with higher scores indicating better credit risk. Factors contributing to the score include payment history, credit utilization, length of credit history, types of credit in use, and recent credit inquiries.

Current Trends in Credit Scores

Recent data from Experian shows that the average credit score in the UK has risen to 711, reflecting improved financial management among consumers. During the COVID-19 pandemic, many individuals took proactive steps to manage their finances better, which positively impacted their credit scores. Additionally, mortgage lenders have increasingly been using alternative data to assess creditworthiness, which has thrown a spotlight on the importance of maintaining a good credit history.

How Does a Credit Score Affect Your Finances?

A good credit score can lead to more favorable terms when applying for loans and credit cards, including lower interest rates and higher credit limits. Conversely, a poor credit score can restrict your financial options and could result in higher interest rates or denial of credit altogether. Notably, many landlords and employers also check credit scores as a part of their vetting processes.

Conclusion

In conclusion, understanding and maintaining a good credit score is essential for anyone looking to secure their financial future. With the average score on the rise, it is a perfect time for individuals to review their credit reports regularly, correct any inaccuracies, and cultivate responsible financial habits. As financial institutions continue to tighten lending criteria, your credit score will remain a key factor in accessing financial opportunities and achieving economic stability.