The Rise and Importance of PayPal in Digital Payments

Introduction

In the rapidly evolving world of digital transactions, PayPal has become an essential player, revolutionising how individuals and businesses manage online payments. Its significance is underscored by its widespread acceptance, user-friendly interface, and robust security measures. With increasing numbers of consumers turning to online shopping and services, understanding PayPal’s evolution and role in this landscape is crucial.

The Transformation of Online Payments

Founded in December 1998, PayPal started as Confinity, a company focused on software for handheld devices, before pivoting to online payments. By 2000, it had merged with X.com, founded by Elon Musk, which later became known as PayPal. In 2002, eBay acquired PayPal for $1.5 billion, cementing its place as the primary payment method on the e-commerce platform.

The company has continually adapted to the changing needs of consumers and merchants. The rise of mobile payments, particularly during the COVID-19 pandemic, has accelerated PayPal’s growth, with a reported increase of 50% in quarterly payment volumes in 2020. As of 2023, PayPal boasts over 400 million active accounts worldwide, affirming its position as a leader in the online payment industry.

Security and Consumer Trust

One of PayPal’s strongest attributes is its commitment to security and fraud prevention. The platform employs advanced encryption and monitoring techniques to protect user data and prevent unauthorised transactions. A 2022 survey indicated that 71% of consumers trust PayPal more than other payment methods, highlighting the importance of security in consumer choices.

Future Trends and Developments

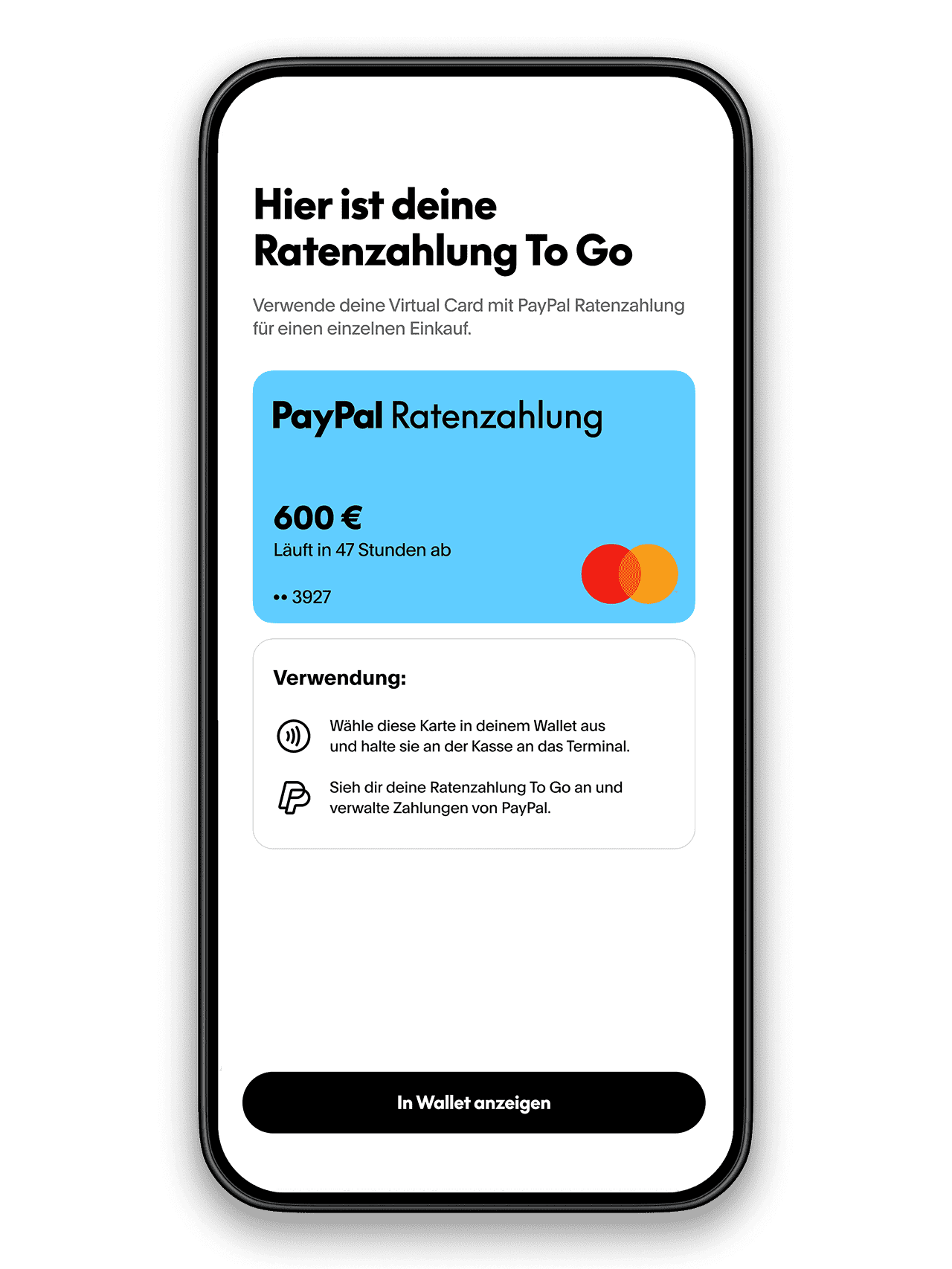

Looking ahead, PayPal continues to innovate with features such as ‘Buy Now, Pay Later’ options and expanding cryptocurrency support, allowing customers to buy, sell, and hold various cryptocurrencies. This is a significant step towards diversifying payment solutions in response to market demands. Additionally, with the rise of e-commerce and digital wallets, PayPal plans to enhance its partnerships with other fintech services and explore further integrations with retailers and service providers.

Conclusion

PayPal’s journey from a niche payment processor to a global leader in online transactions exemplifies the dynamic nature of digital finance. As more individuals and businesses embrace online payments, PayPal’s role is poised to expand even further. With ongoing innovations and a focus on security, PayPal remains a pivotal player in shaping the future of digital payments, making it essential for consumers and merchants alike.