Understanding the Alphabet Share Price Trends

The Importance of Alphabet Share Price

The Alphabet share price is a critical indicator of the performance and health of one of the largest technology companies in the world. As the parent company of Google, Alphabet’s stock reflects not only its own financial status but also broader trends in the tech industry, advertising market, and overall economic conditions. Understanding Alphabet’s share price movements is essential for investors, analysts, and anyone interested in the technology sector.

Current Trends and Data

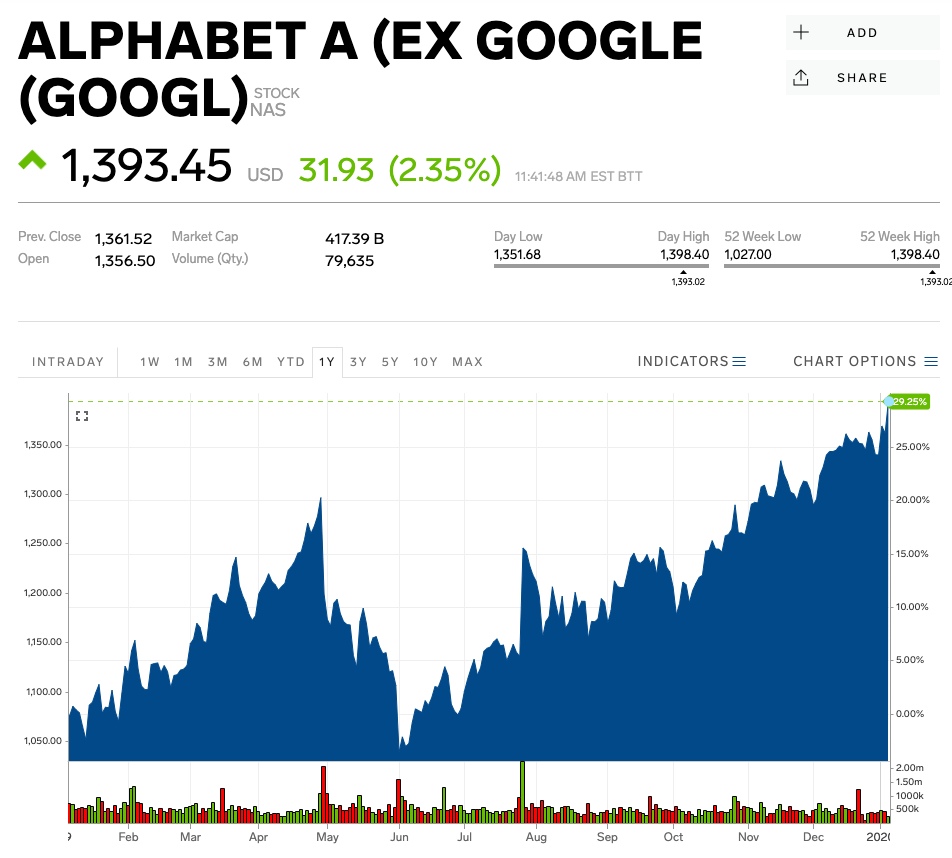

As of October 2023, Alphabet’s share price has experienced fluctuations due to various factors, including earnings reports, changes in consumer behaviour, and economic conditions. Recently, Alphabet reported better-than-expected earnings for the third quarter, which significantly boosted investor confidence. The company’s focus on artificial intelligence (AI) and online advertising has been a significant growth driver.

Analysts have noted that Alphabet’s share price reached an all-time high of $150 per share in September 2023, following a robust performance in its cloud division and digital ad revenue recovery. Market experts predict that the share price could continue on an upward trajectory if Alphabet maintains its growth strategy and capitalises on emerging technologies.

Factors Influencing the Share Price

Several external and internal factors influence the share price of Alphabet. Key among them are:

- Market Trends: The technology sector often reacts to broader stock market trends. For instance, if the overall market sees a downturn, tech stocks, including Alphabet, may be adversely affected.

- Regulatory Environment: Alphabet faces scrutiny over antitrust issues, and any new regulations could impact investor sentiment and, consequently, the share price.

- Innovation and Product Releases: The introduction of new products and services, especially in AI, can create positive sentiment around the company and influence the stock price positively.

Conclusion

In conclusion, the Alphabet share price remains a closely watched barometer of both the company’s performance and the health of the tech sector at large. Investors should pay attention to quarterly earnings reports, market trends, and regulatory changes that could impact Alphabet’s future. Forecasts suggest a potentially positive outlook for the share price, contingent on the company’s ability to innovate and adapt in an ever-changing technological landscape. For those considering investing, understanding these dynamics will be pivotal in making informed decisions.