Understanding the Bank of England Base Rate Changes

Importance of the Bank of England Base Rate

The Bank of England base rate is a critical tool in the UK’s monetary policy, influencing borrowing costs, spending behavior, and overall economic growth. As inflationary pressures and economic conditions fluctuate, the base rate serves as a barometer of financial stability and investor confidence. Recent developments in the base rate have become particularly pertinent as the UK navigates post-pandemic recovery and ongoing inflationary challenges.

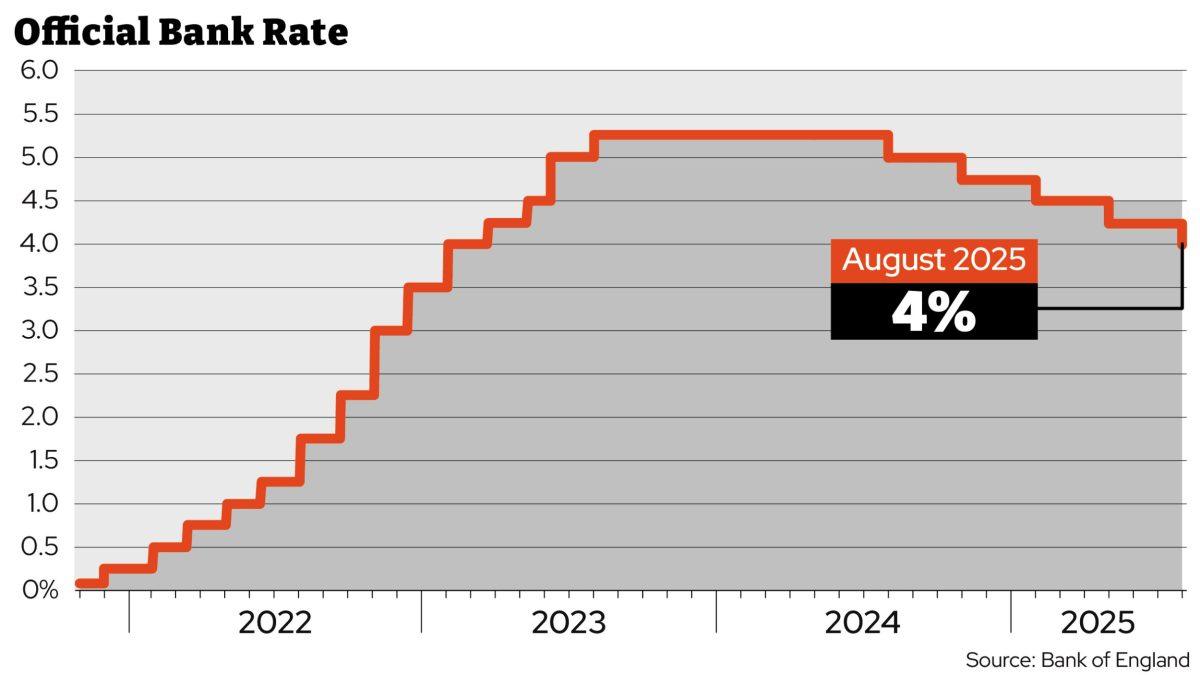

Recent Changes to the Base Rate

As of October 2023, the Bank of England has raised its base rate to 5.25%, reflecting ongoing concerns over inflation, which has remained above the target level of 2%. This increase follows a series of hikes over the past year, aimed at reining in persistent price increases that have impacted households and businesses across the country. In August, the rate was set at 5.0%, marking a pattern of tightening policy in response to economic pressures.

Impact on Consumers and Businesses

The implications of the base rate hike are significant for consumers and businesses alike. For homeowners with variable-rate mortgages, higher rates mean increased monthly repayments, putting additional strain on household budgets. For businesses, the rising cost of borrowing can deter investment and expansion plans, potentially leading to slower economic growth. Consumer spending may also decline as people prioritise mortgage repayments over discretionary spending.

Predictions and Future Trends

Economists are divided on the future direction of the Bank of England’s base rate. Some forecast further increases as inflation persists, while others suggest that economic growth could moderate, potentially leading to a decision to hold the rate steady or even reduce it in the next year. Analysts are closely monitoring the UK’s inflation rate, wage growth, and overall economic performance to gauge how these factors may influence the Bank’s decision-making going forward.

Conclusion

The Bank of England base rate is a key driver of the UK economy, affecting every aspect of financial activity from individual mortgages to business loans. With current challenges related to inflation and economic growth, understanding these rate changes is crucial for both consumers and stakeholders in the financial markets. Looking ahead, as the Bank of England continues to adapt its policies in response to economic signals, the potential impact on the wider economy remains an important area for observation.