Understanding the Current Centrica Share Price Trends

Introduction

The share price of Centrica, a leading British utility services company, is a critical indicator of its financial health and investor sentiment. As a major player in the energy market, understanding its share price trends is essential for investors and market analysts alike, especially in the context of fluctuating energy demand and ongoing regulatory changes.

Current Trends

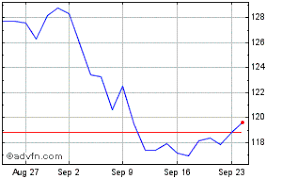

As of October 2023, Centrica’s share price has experienced significant fluctuations, primarily influenced by a combination of rising energy prices, regulatory changes, and market competition. The company’s strategic initiatives, including investments in renewable energy and efforts to improve customer service, have also played a role in shaping investor confidence.

Over the past month, Centrica’s shares have risen approximately 10%, reflecting positive market sentiments following the announcement of a new deal aimed at expanding its renewable energy portfolio. Analysts predict this trend may continue, provided that the company successfully navigates the challenges posed by regulatory frameworks and the broader energy market landscape.

Market Performance

Centrica’s stock performance is not only a reflection of its business health but also indicative of broader economic conditions. Recent reports suggest that the energy sector is poised for growth, especially in the renewables market. Despite facing challenges from rising operational costs, Centrica’s share price increase signals resilience and adaptability in a competitive market.

Future Outlook

Looking ahead, the future of Centrica’s share price will largely depend on its ability to execute its strategic plans, including enhancing its service offerings and expanding its renewable energy investments. Financial analysts remain cautiously optimistic, forecasting a potential increase in share price over the next year, assuming that energy prices remain stable and government policies favour sustainable energy solutions.

Conclusion

In conclusion, the dynamics surrounding Centrica’s share price are indicative of both the company’s performance and the wider energy market. For investors, monitoring the company’s strategic moves and market conditions will be vital in making informed investment decisions. With ongoing developments in the energy sector, Centrica’s trajectory remains a key interest for stakeholders engaged in the utility services landscape.