Understanding the Current Landscape of Bitcoin

The Importance of Bitcoin in Today’s Economy

Bitcoin continues to resonate globally as a pioneering cryptocurrency, capturing the interest of investors and tech enthusiasts alike. Since its inception in 2009, Bitcoin has revolutionised the financial landscape, introducing decentralised digital currency that operates outside traditional banking systems. Its significance has escalated, particularly in light of growing inflation and economic uncertainties, prompting individuals and institutions to view Bitcoin as a viable alternative asset.

Recent Trends and Developments

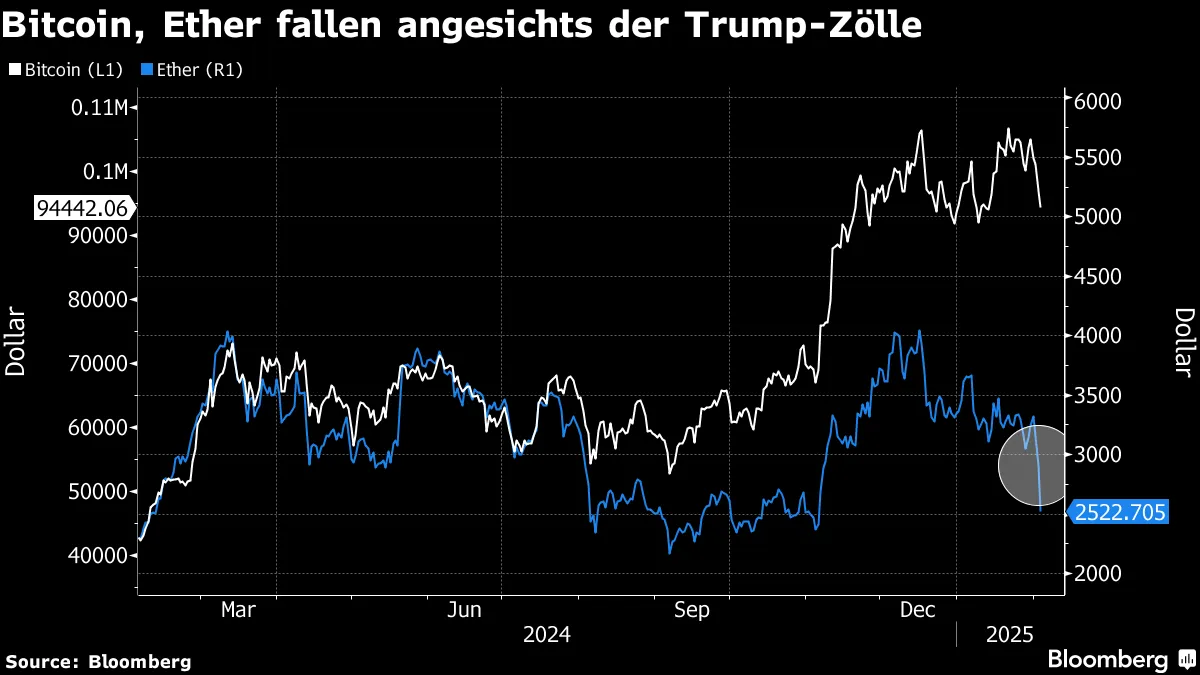

The Bitcoin market has showcased notable volatility this year, with prices fluctuating significantly. As of October 2023, Bitcoin has seen a resurgence, trading at approximately £30,000, following a dip earlier in the year. Analysts attribute this recovery to increased institutional interest, expanding acceptance amongst retail merchants, and the potential for Bitcoin spot ETFs, which could enable broader market exposure. Key players like BlackRock and Fidelity have entered the crypto space, fuelling optimism for future price stability.

Furthermore, the regulatory environment surrounding Bitcoin has evolved. Authorities in various countries are implementing frameworks to govern cryptocurrency transactions better. Notably, the European Union is advancing legislative measures to offer clear guidelines, aiming to protect investors while fostering innovation within the sector. Such regulatory clarity may enhance Bitcoin’s credibility and attract more traditional investors leery of a previously unregulated market.

Challenges Ahead

Despite its recent rally, Bitcoin faces several challenges that could impede further growth. The ongoing debate over its environmental impact, primarily due to energy-intensive mining practices, raises sustainability concerns. Several countries have imposed restrictions on Bitcoin mining to conserve energy, forcing miners to adapt or relocate. Additionally, fluctuations in regulatory stances could lead to heightened uncertainty in the market.

Conclusion: The Future of Bitcoin

As Bitcoin progresses into the final quarter of 2023, its trajectory remains a topic of keen interest. Market dynamics suggest that while there are inherent risks, the potential rewards may tempt investors willing to navigate the crypto landscape. Bitcoin’s integration into mainstream finance appears poised for a continuance, setting the stage for a transformative future. Ultimately, whether Bitcoin can sustain its momentum will depend on broader economic trends, regulatory developments, and its ability to overcome the challenges that lie ahead.