Understanding the Dow Jones Industrial Average

The Importance of the Dow Jones

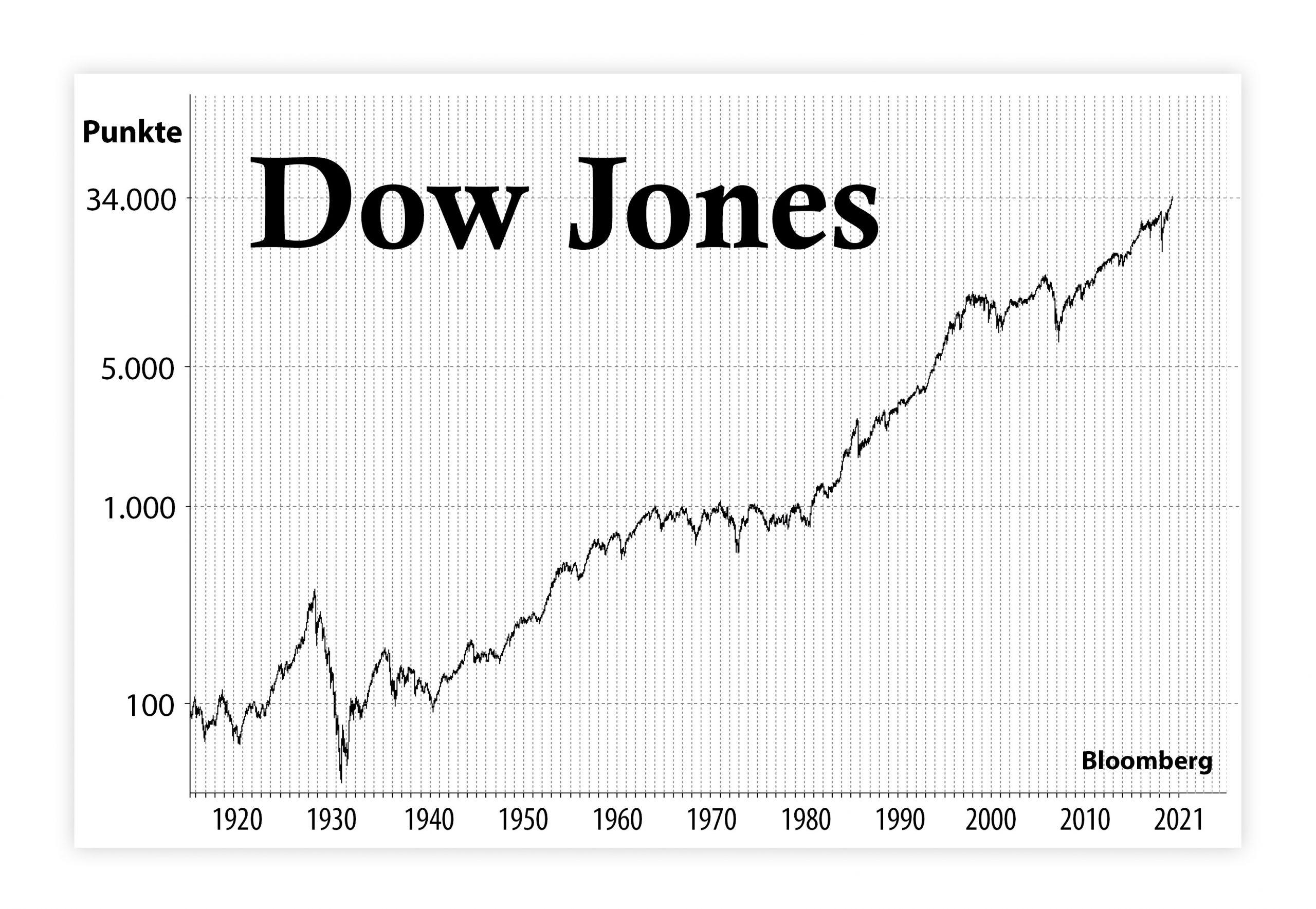

The Dow Jones Industrial Average (DJIA) is one of the most closely watched stock market indices globally. Established in 1896, it represents 30 significant publicly traded companies in the United States and serves as a barometer for the overall performance of the American economy. Investors, analysts, and policymakers closely monitor the DJIA as it provides insights into market trends and investor sentiment.

Current Developments in the Dow Jones

As of October 2023, the Dow Jones has seen several fluctuations due to various economic factors including interest rate hikes, inflation rates, and geopolitical tensions. The index recently climbed above the 35,000 mark amid reports of better-than-expected corporate earnings from major companies like Apple and Microsoft. Analysts attribute this rise to investor optimism about a potential recession being avoided and strong consumption figures.

However, concerns remain regarding inflation, which still poses challenges for Federal Reserve policies. In their recent meeting, the Federal Reserve opted to keep interest rates steady, a decision met with mixed reactions from the market. Some investors fear that sustaining higher interest rates for an extended period could dampen consumer spending and business investment, which in turn would affect the earnings of companies listed in the DJIA.

Key Sectors Influencing the Index

The performance of the Dow Jones is significantly influenced by sectors such as technology, healthcare, and financials. Currently, technology stocks are leading the way, rebounding from previous lows caused by fears related to rising interest rates. Healthcare stocks have also shown resilience, driven by ongoing demand for health services and products post-pandemic. Financial stocks, while experiencing a boost from rising rates, are under scrutiny due to concerns about potential defaults as economic conditions remain uncertain.

Conclusion and Forecasts

The Dow Jones Industrial Average remains an essential indicator of market health and investor confidence. Predictions for the coming months are mixed; while some analysts suggest that the index could maintain its upward momentum, others warn of potential corrections if economic indicators do not match investor expectations. For readers and investors, keeping a close eye on the DJIA, along with broader economic trends, will be crucial in navigating the complexities of the current market landscape.