Understanding the DWP State Pension Increase for 2024

Introduction

The Department for Work and Pensions (DWP) plays a vital role in managing state pensions in the UK, significantly impacting the financial wellbeing of millions of retirees. With the cost of living continuously rising, discussions surrounding the annual increase in state pensions have become particularly relevant. In 2024, the government has outlined expected changes to the state pension rates, which are crucial for those relying on this income.

Current State Pension Rates

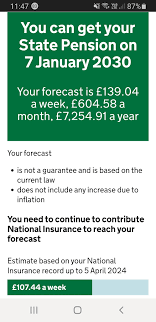

The basic state pension currently stands at £141.85 per week for eligible individuals who reached state pension age before April 6, 2016. Those who fall under the new state pension scheme, introduced in 2016, receive a flat rate of £203.85 per week if they have made 35 years of National Insurance contributions. The impending increase will provide essential support as inflation continues to affect the cost of everyday living.

Details of the Increase

The DWP has announced a proposed increase of 8.5% for the 2024-2025 tax year, triggered by the triple lock mechanism that ensures pensions rise by either 2.5%, inflation rate, or average earnings growth—whichever is highest. Given the rising inflation rates over the past year, many analysts believe this will result in significant increases for pensioners. This adjustment aims not only to alleviate financial strain on retirees but also to ensure they can maintain a decent standard of living.

Impact on Retirees

The projected rise in state pensions is projected to benefit around 12 million pensioners across the UK, equating to an increase of approximately £17.25 per week for the basic state pension. For those on the new state pension, this could mean an additional £16.80 a week, helping to offset the rising costs of housing, utilities, and essential goods. This increase is crucial for many who are struggling financially, particularly amidst the ongoing energy crisis and inflationary pressures.

Conclusion

The DWP state pension increase is a significant development for retirees in the UK. With approval expected in the coming months, it is an important opportunity for the government to reaffirm its commitment to supporting the elderly population. As we approach 2024, stakeholders encourage these adjustments while urging continued discussions on the sustainability of the pension system. Moving forward, the challenge will be ensuring that these increases keep pace with inflation and evolving economic circumstances, safeguarding retirees’ financial security.