Understanding the Latest Trends in Boohoo Share Price

Introduction

The share price of Boohoo, a leading British online clothing retailer, has garnered significant attention among investors and analysts. As one of the most prominent players in the fast fashion sector, the fluctuation in Boohoo’s share price can be crucial for understanding the broader health of the retail market. This article explores the recent trends and factors influencing Boohoo’s share performance, particularly in a post-pandemic environment.

Current Performance

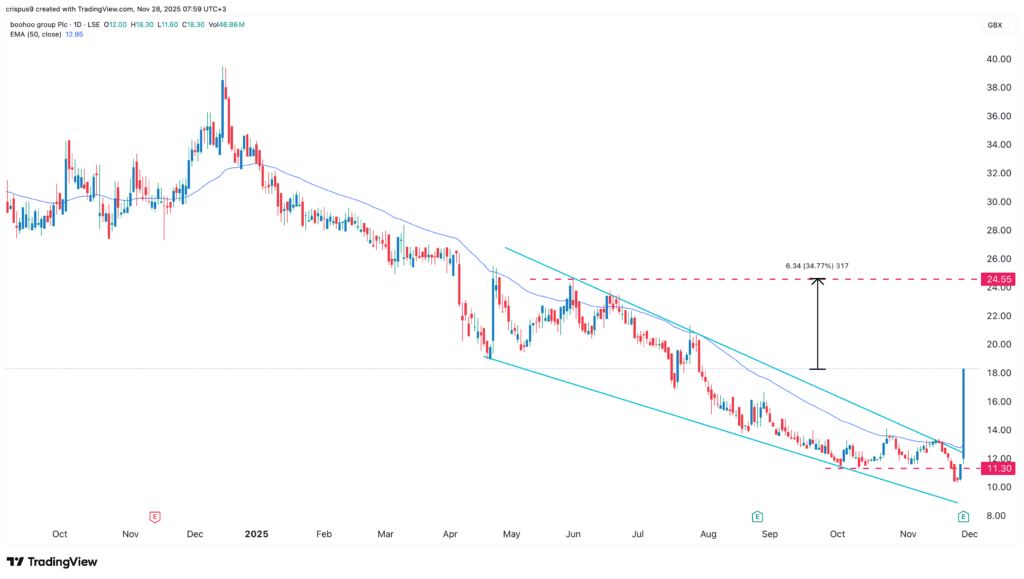

As of October 2023, Boohoo’s share price has been under pressure due to a combination of factors including changing consumer behaviour and market dynamics. After peaking in 2020 amid the pandemic-driven online shopping boom, the share price has faced volatility as shoppers have begun returning to physical stores. Recent data indicates that Boohoo’s share price was trading at approximately £0.45, a significant drop from its earlier highs.

Factors Influencing Share Price

Several key factors have impacted Boohoo’s share price in recent months:

- Consumer Sentiment: A shift in consumer preferences towards sustainability and quality over fast fashion has posed challenges for Boohoo.

- Financial Performance: The company’s earnings reports have shown a decline in sales, prompting concerns about future growth.

- Market Competition: Increased competition from both established retailers and new entrants in the online fashion space has intensified pressures on Boohoo’s market share.

- Regulatory Environment: Legislative changes in the UK and EU aimed at improving the fashion industry’s sustainability could lead to increased operational costs for Boohoo.

Outlook and Forecasts

Looking ahead, analysts remain cautious about Boohoo’s short-term recovery but see potential for long-term growth if the company can adapt to changing market trends. Predictions suggest that for Boohoo to regain investor confidence, it must demonstrate a commitment to sustainability while innovating its product offerings. Additionally, effective marketing strategies targeting Gen Z consumers may be essential for rejuvenating its brand image.

Conclusion

The current state of Boohoo’s share price reflects broader challenges faced by the fast fashion industry. While recent performance has been disappointing, the company has the opportunity to pivot and meet market demands for responsible consumption. Investors should monitor ongoing developments closely, as shifts in consumer behaviour and effective strategic changes could substantially influence Boohoo’s share price trajectory in the coming quarters.