Understanding the Nikkei 225: A Key Indicator of Japan’s Economy

Introduction to the Nikkei 225

The Nikkei 225 is one of the most closely watched stock market indices in Asia, serving as a barometer for the health of Japan’s economy. As Japan’s premier stock index, it encompasses 225 prominent companies listed on the Tokyo Stock Exchange, representing a broad spectrum of industries. The index’s movements can influence global markets, making it a critical point of interest for investors worldwide.

Recent Trends and Developments

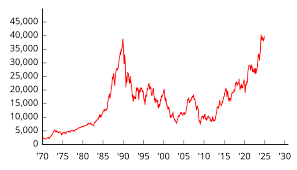

As of October 2023, the Nikkei 225 has been experiencing significant fluctuations, primarily driven by changes in global economic conditions and domestic policy decisions. Following a period of volatility in early 2023, the index showed a remarkable recovery, reaching its highest levels in over 30 years in August, buoyed by robust corporate earnings and increased foreign investments.

Key companies within the index, such as Toyota, Sony, and SoftBank, have reported strong earnings, contributing to the overall positive sentiment. Analysts attribute this surge to Japan’s effective handling of inflation and government initiatives aimed at stimulating the economy. The Bank of Japan’s (BoJ) monetary policy, which has maintained low-interest rates, has also encouraged investment and consumption.

Factors Influencing the Nikkei 225

Several factors contribute to the movement of the Nikkei 225. These include:

- Global Economic Conditions: International trade relations, especially between Japan and major economies like the United States and China, heavily influence investor confidence in Japan’s markets.

- Domestic Policy Changes: The Japanese government’s strategies through fiscal measures and reforms also play a vital role in shaping the economic landscape.

- Exchange Rates: The strength of the Yen against other currencies can affect export-driven companies in the Nikkei 225, impacting their profitability and stock performance.

Conclusion and Forecasts

The Nikkei 225 remains a pivotal indicator of not just Japan’s economic health, but also a critical market for international investors looking for opportunities in Asia. Experts predict that the index may continue to experience volatility, influenced by ongoing global economic shifts and Japan’s domestic policies. Investors are encouraged to monitor these developments closely, as the trends in the Nikkei 225 can have significant ramifications across global markets.