Understanding the Nikkei 225 Index: Current Trends and Implications

Introduction

The Nikkei 225 is one of the most significant stock market indices in Asia, representing the performance of the Tokyo Stock Exchange’s leading 225 companies. It serves as a critical indicator of the Japanese economy and provides insight into the broader trends in the Asia-Pacific economic landscape. Given its vital role, understanding the recent movements of the Nikkei 225 is essential for investors, analysts, and anyone interested in global financial markets.

Recent Performance

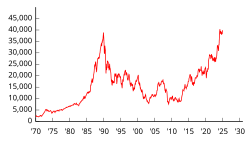

As of late October 2023, the Nikkei 225 index has shown notable resilience amid a tumultuous global market environment. Currently, it hovers around 32,000 points, reflecting a steady increase of approximately 15% year-to-date. Factors contributing to this upward momentum include strong corporate earnings, positive economic data from Japan, and a generally optimistic outlook for Asia as part of the global recovery from the pandemic’s economic impact.

During the third quarter of 2023, companies such as Sony, Toyota, and SoftBank have posted robust earnings that beat market expectations. Analysts attribute this performance to effective management strategies and increased consumer demand, both domestically and internationally.

Global Influence

The Nikkei 225 is closely watched by investors far beyond Japan’s borders. Influenced by international market trends, currency fluctuations, and geopolitical events, the index reacts to developments worldwide. For instance, the recent shifts in the Federal Reserve’s interest rate policies and ongoing trade relationships in Asia have been significant determinants of the Nikkei’s performance.

Market Outlook

Looking ahead, analysts forecast that the Nikkei 225 may experience volatility as investors react to expected interest rate hikes and potential economic slowdowns in other major economies. However, fundamentals remain strong in many Japanese corporations, and the government’s commitment to structural reforms could enhance long-term growth prospects.

Conclusion

The Nikkei 225 index continues to be a bellwether for investors interested in the Japanese economy and broader Asian market dynamics. Given its recent performance and the ongoing recovery trajectory in Japan, the index will likely remain a focal point for financial analysis in the months to come. Investors should keep a close eye on developments impacting the index, as they can serve as indicators of future economic health and opportunities in the region.