Understanding the UK State Pension in 2023

Introduction to the UK State Pension

The UK state pension is a crucial component of the financial safety net for retirees, providing a basic income to support those in retirement. As the population ages and life expectancy rises, the relevance of understanding the state pension system has never been more critical, not only for current pensioners but also for those planning for their retirement.

Current State Pension Rates

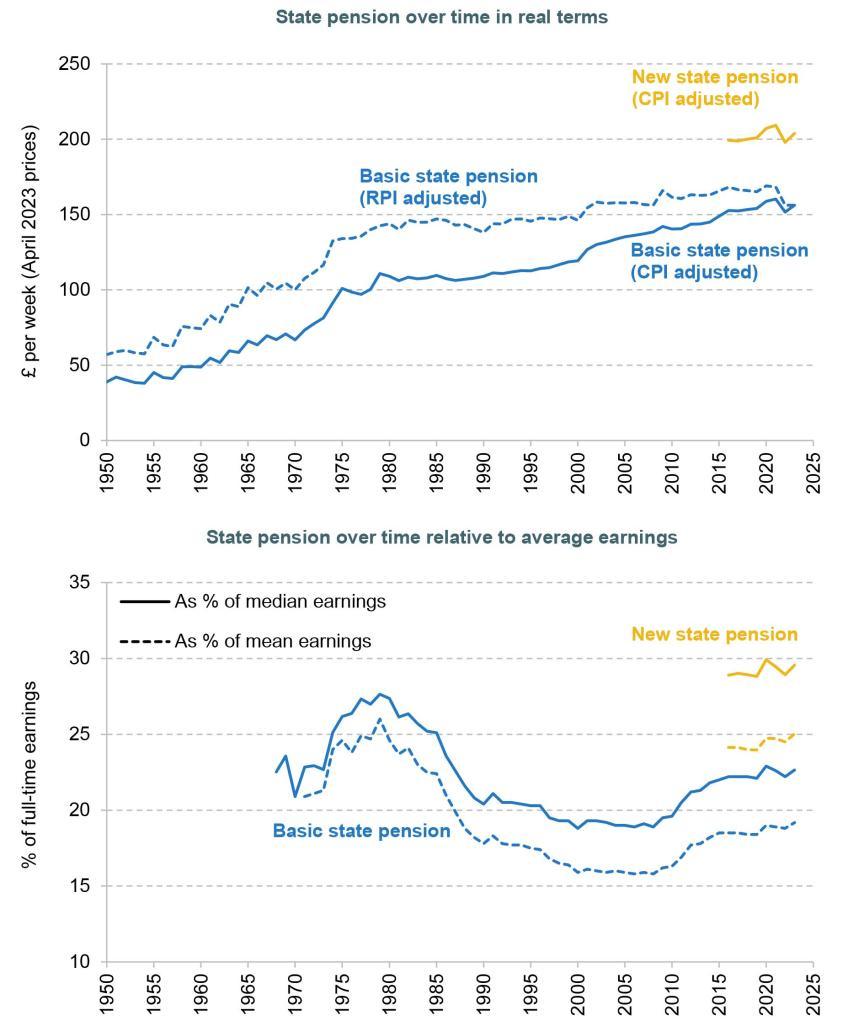

As of April 2023, the full new state pension stands at £203.85 per week, an increase from the previous year, reflecting the government’s commitment to adjusting payments in line with inflation. The increase is part of the government’s triple lock policy, which ensures that pensions rise each year by the highest of inflation, average earnings growth, or 2.5%. This policy aims to protect the purchasing power of retirees.

Eligibility and Contributions

To qualify for the full new state pension, individuals need 35 qualifying years of National Insurance contributions. Those with fewer years may receive a reduced amount. Many people are unaware that they can potentially fill gaps in their contribution history by making voluntary National Insurance contributions, which can significantly increase their future pension benefits.

Recent Developments and Changes

In 2023, the UK government also announced plans to review the state pension age, which currently stands at 66 for both men and women and is set to rise to 67 by 2028. This change is part of broader reforms aimed at ensuring the sustainability of the state pension system, particularly as demographic trends show a growing population of retirees relative to working-age individuals.

Conclusion and Future Implications

As discussions around pension policy continue, it’s essential for individuals to stay informed about potential changes that may affect their retirement planning. The state pension remains a vital source of income for millions in the UK and will likely be a focal point in future policy debates. Navigating these changes effectively can help individuals secure a more stable financial future as they approach retirement.