Understanding Current Trends in Gold Price

Introduction

The price of gold has long been a crucial indicator of economic stability and has captivated investors’ attention worldwide. As a hedge against inflation and currency fluctuations, understanding the trends in gold price is essential for individuals and institutions alike. With recent economic uncertainties and geopolitical tensions, the fluctuations in gold prices have become particularly relevant.

Recent Trends in Gold Price

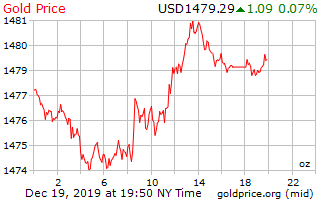

As of October 2023, the gold price has witnessed significant volatility. According to recent data from the World Gold Council, the average price of gold reached approximately £1,600 per ounce, a slight increase from the previous quarter. This rise is attributed to several factors, including inflationary pressures and ongoing conflicts in Eastern Europe, which have heightened demand for safe-haven assets.

In addition to geopolitical factors, the central banks globally have accelerated their gold purchases in response to fluctuating fiat currencies. The Financial Times reports that central banks bought a record amount of gold in the first half of the year, signalling a shift towards securing assets considered stable amidst economic turmoil.

Market Insights

On the market front, analysts project continued fluctuations in gold prices due to forthcoming interest rate announcements by major central banks such as the Bank of England and the Federal Reserve. A rate hike typically strengthens the US dollar, which can put downward pressure on gold prices. However, the counterbalance of inflation may keep gold’s appeal strong among investors.

Furthermore, recent retail demand statistics show a rebound in physical gold purchases, such as gold bullion coins and bars, as consumers seek to protect their wealth from inflation. The Royal Mint reported a 20% increase in the sale of gold coins this year, affirming the public’s growing confidence in the metal’s long-term value.

Conclusion

The gold price remains a pivotal element of financial markets, reflecting investor sentiment and economic conditions. While recent trends indicate a rise in gold prices, various factors could influence these changes in the upcoming months. Investors should stay informed on both macroeconomic developments and central bank policies to navigate the gold market effectively. As gold continues to attract attention as a refuge in times of volatility, its relevance in investment strategies will undoubtedly remain significant.