Current Bank Interest Rates: Trends and Implications for 2023

The Importance of Bank Interest Rates

Bank interest rates play a crucial role in the financial landscape, influencing everything from mortgage payments to savings returns. As the UK continues to navigate a post-pandemic economy marked by inflation concerns and changing monetary policies, understanding these rates has never been more significant for consumers and businesses alike.

Current Trends in Bank Interest Rates

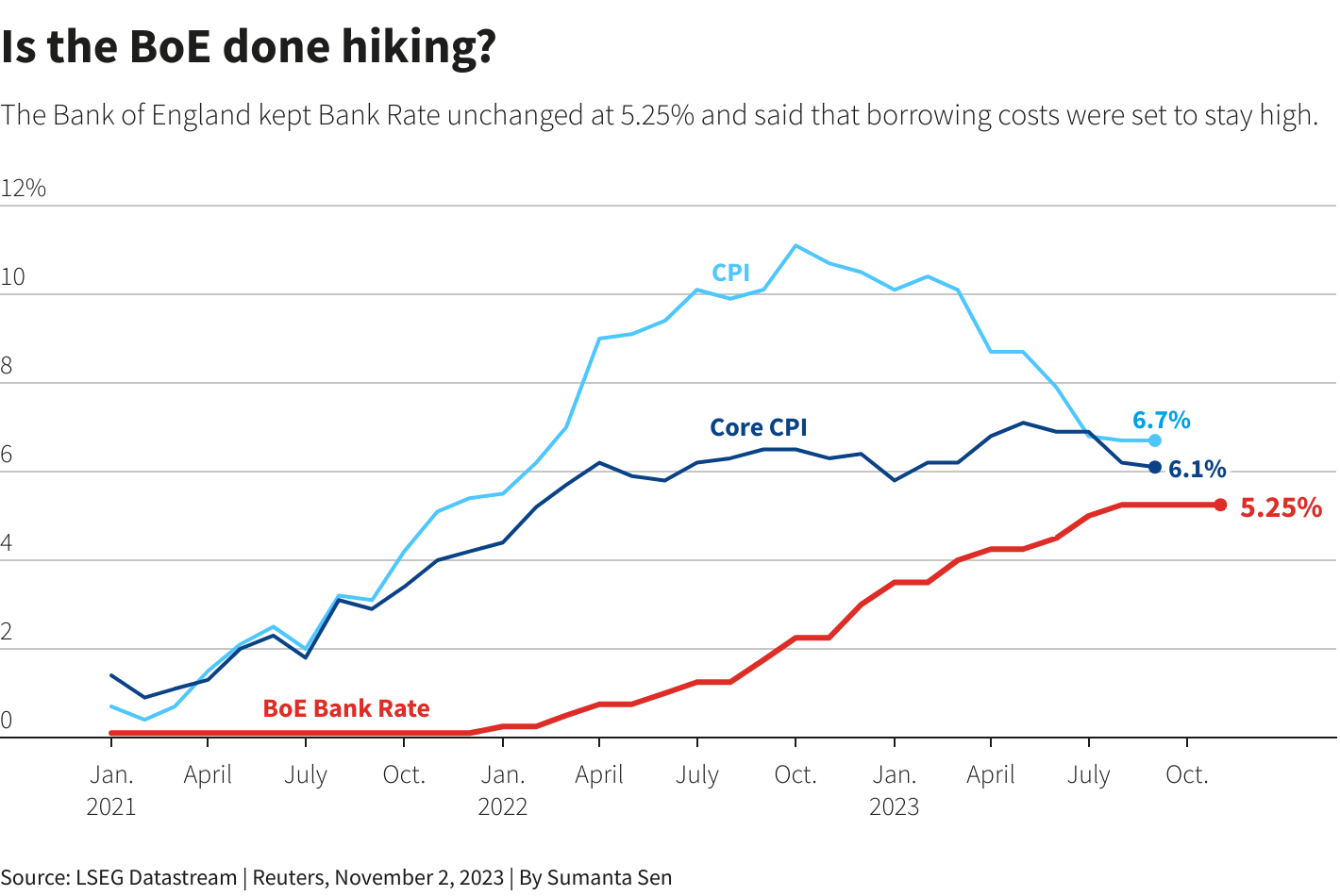

As of October 2023, the Bank of England has raised the base interest rate to 5.25%, responding to ongoing inflationary pressures. This marks a significant increase from the historically low rates experienced during the pandemic. High street banks are reflecting this trend by adjusting their savings rates and loan prices. According to data from Moneyfacts, the average easy access savings account rate now hovers around 1.73%, while fixed-rate mortgages have seen hikes, with two-year fixed deals averaging around 6.42%.

The Impact on Borrowers and Savers

For borrowers, the increase in interest rates means higher monthly payments on variable rate loans and mortgages. Homebuyers are particularly affected, as the cost of borrowing has surged. Financial analysts predict a slowdown in the housing market as potential buyers reconsider affordability amidst rising rates. On the other hand, savers may benefit, as higher interest rates make savings accounts more attractive. However, the level of returns may still not outpace inflation, which remains above the target set by the government.

Future Forecasting

Looking ahead, many economists expect that the Bank of England may continue to adjust interest rates in response to inflationary trends. If inflation continues to rise above expectations, rates could further increase. On the contrary, if inflation stabilizes, a potential reduction in rates could occur by the latter half of 2024. For consumers, it is essential to stay informed about these changes to effectively manage their finances.

Conclusion

In conclusion, bank interest rates are a key factor affecting both consumers and businesses in the UK. As 2023 progresses, staying updated on these rates will be crucial for making informed financial decisions. Whether you are looking to save, borrow, or invest, understanding the dynamics of interest rates is vital in today’s economic environment.