Current Insights into Amazon’s Share Price

Introduction

The Amazon share price remains a key indicator of the company’s financial health and market performance, making it a subject of interest for investors worldwide. As one of the most prominent players in the e-commerce and cloud computing sectors, fluctuations in Amazon’s stock not only affect its investors but also reflect broader economic trends.

Current Trends and Analysis

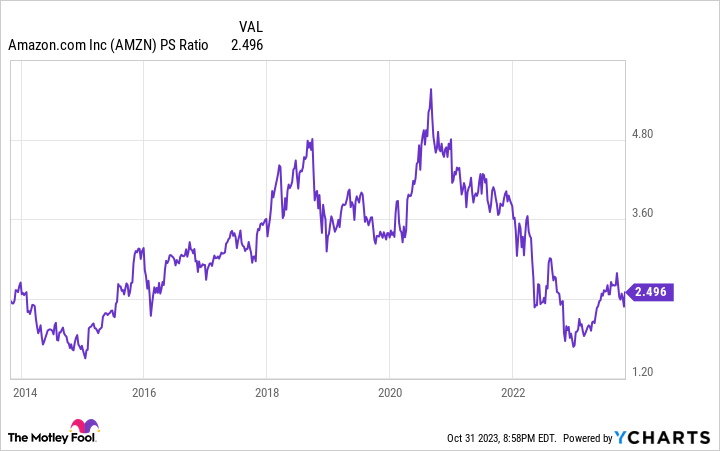

As of late October 2023, Amazon’s share price has experienced significant volatility due to various market dynamics. Recent economic reports, including interest rate announcements and inflation figures, have played a crucial role in shaping investor sentiment. Currently, Amazon’s stock is priced at approximately £120 per share, showing a 15% increase over the last quarter.

Several factors contribute to the recent rise in share price. Analysts attribute this to Amazon’s robust quarterly earnings report, which exceeded market expectations. The company reported revenues of £164 billion, driven heavily by growth in its Prime membership and AWS (Amazon Web Services) segments. In addition, strategic initiatives, such as investments in artificial intelligence and sustainable energy, have been positively received by the market.

Market Influencers

However, the tech sector, including Amazon, is facing challenges that could influence future share prices. Regulatory scrutiny and global supply chain issues present ongoing concerns for the e-commerce titan. Investor reactions to these developments, along with macroeconomic indicators, will likely play a vital role in shaping Amazon’s stock trajectory in the coming months.

Conclusion

Looking ahead, analysts remain cautiously optimistic about Amazon’s share price. If the company continues to innovate and adapt to market changes, it could sustain its growth momentum. Investors are advised to monitor both industry trends and broader economic factors that may impact Amazon’s performance. Overall, the Amazon share price is not just a reflection of the company’s current state but also an essential gauge for the technology market’s health.