Understanding the Triple Lock: A Safety Net for Pensions

Introduction

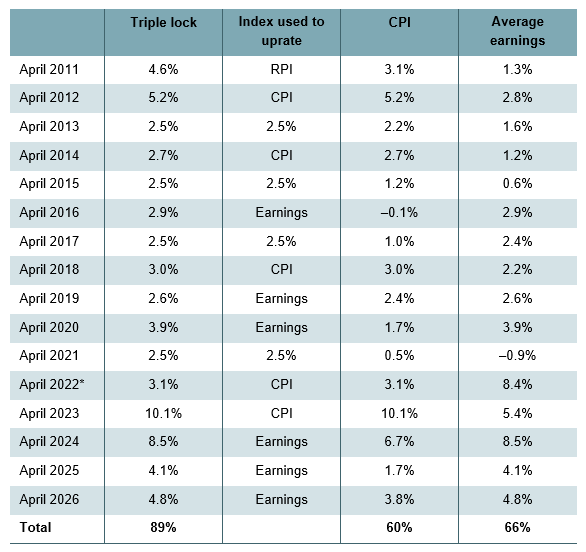

The Triple Lock system has emerged as a significant topic in recent years, particularly concerning the financial security of pensioners in the UK. Introduced in 2010, this policy guarantees that the state pension increases each year by the highest of three measures: inflation, average earnings, or a fixed rate of 2.5%. With debates around public spending and the sustainability of pension systems heating up, understanding the Triple Lock’s importance is crucial for both current and future pensioners.

The Mechanics of the Triple Lock

The Triple Lock was designed to provide a safety net to ensure that pensions keep pace with the cost of living and wage rises. Here’s how it works:

- Inflation: The state pension increases in line with the Consumer Prices Index (CPI), which measures inflation based on the cost of everyday goods and services.

- Earnings: The state pension can also rise in accordance with average earnings, ensuring pensioners benefit when the workforce sees salary increases.

- Fixed Rate: Regardless of the other two measures, pensions increase by at least 2.5% each year, protecting them against stagnant wage growth or low inflation.

Recent Developments

In recent years, the Triple Lock has faced scrutiny during budget discussions. In 2021, the UK government temporarily suspended the Triple Lock policy due to wage fluctuations caused by the COVID-19 pandemic. This raised concerns among pensioners fearing losses to their financial stability. As inflation rates soar, with CPI rising to as high as 4.2% recently, the Triple Lock’s role in protecting pensioners’ purchasing power has come to the forefront again.

Conclusion

The Triple Lock system continues to be a vital component of the UK’s pension framework. While criticisms regarding its sustainability and potential reforms circulate, its primary goal remains—to provide financial security for pensioners. With economic pressures likely to grow, the debate around maintaining the Triple Lock is more pertinent than ever. As we look to the future, it remains essential for policymakers to consider the balance between fiscal responsibility and the welfare of the elderly population.