Understanding the State Pension Age of 67 in the UK

Introduction

The state pension age in the UK is a crucial aspect of the social security system that directly impacts the financial security of millions of retirees. Recently, the government announced a gradual increase in the state pension age to 67 by the year 2028, which raises questions and concerns about retirement planning for many individuals. Understanding these changes is essential for future retirees as they prepare for life after work.

Details of the Changes

The increase of the state pension age from 66 to 67 is part of ongoing reforms aimed at addressing demographic shifts, including increasing life expectancy and an ageing population. According to the UK Government’s official report, this adjustment ensures the sustainability of the state pension system while continuing to provide support to those in retirement.

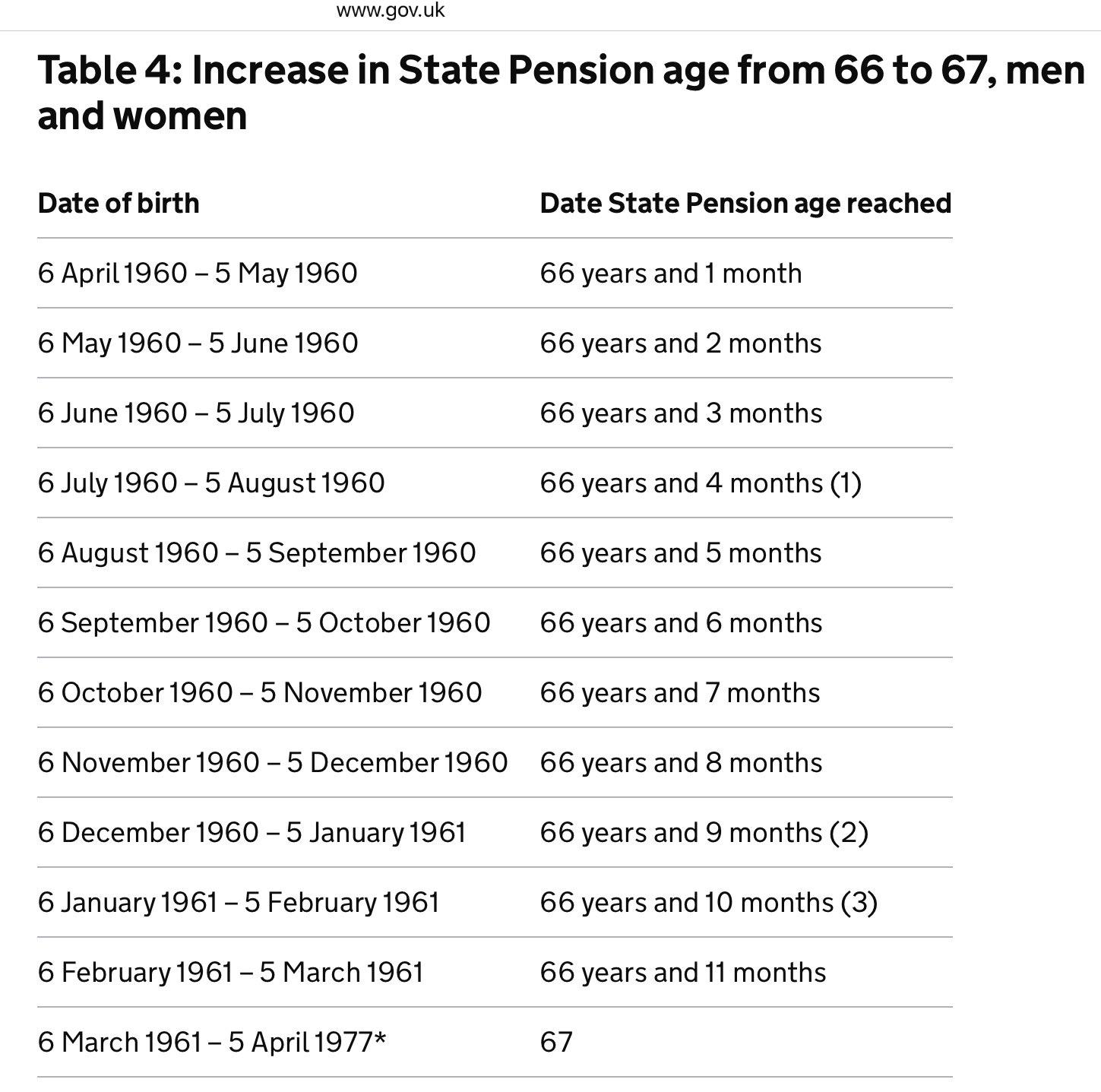

Current estimates suggest that individuals born between April 1960 and March 1961 will be among the last to be affected by this increase, facing a new retirement age of 67. The change will be phased in gradually over a two-year period, allowing individuals to prepare adequately for the transition.

Impacts on Future Retirees

The adjustment has raised concerns regarding the financial readiness of individuals approaching retirement age. Many workers are expressing anxiety about the need to work longer before receiving their state pension benefits. Economic data indicates that those nearing retirement often struggle to remain in the workforce due to health issues and changes in the job market.

Financial advisors recommend that individuals start planning for their pensions early, considering alternatives such as private pensions and savings to bridge the gap as they adjust to the new state pension timeline. Additionally, discussions in Parliament have highlighted the need for increased support for those affected, particularly in sectors facing labor shortages and economic downturns.

Conclusion

The rise in state pension age to 67 has significant implications for future retirees in the UK. As individuals navigate this new landscape, it is crucial for workers and policymakers alike to engage in meaningful dialogue regarding retirement planning and support. With the pension age changes set to take effect, it becomes increasingly important for individuals to review their financial plans and prepare for their eventual retirement. Looking forward, continuous assessments of the state pension system will be necessary to adapt to the evolving needs of the population.