Analyzing the Current Trends in Beyond Meat Share Price

Introduction

The share price of Beyond Meat, known for its innovative plant-based meat alternatives, has become a critical focal point for investors and analysts alike. As trends towards sustainable eating grow, understanding the fluctuations in Beyond Meat’s share price is essential for grasping the future of both the company and the plant-based food market.

Current Market Overview

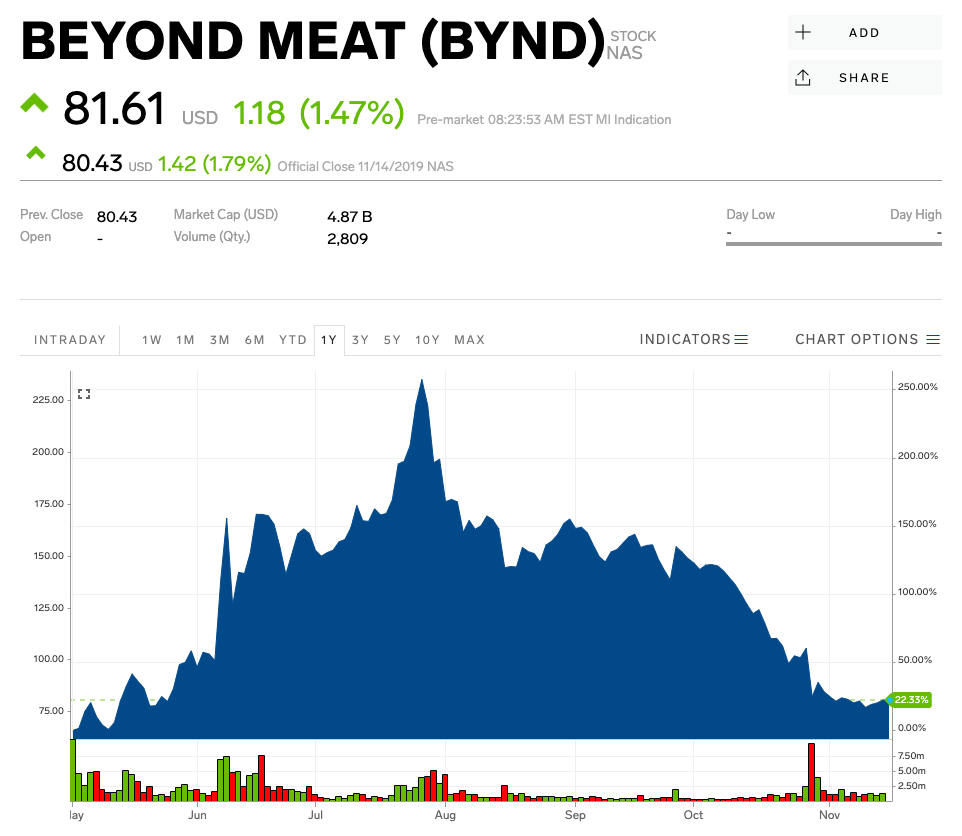

As of October 2023, Beyond Meat’s share price has experienced significant volatility. After a peak in mid-2021 near $239, shares have seen notable declines, impacted by a combination of financial performance, production challenges, and broader market trends affecting tech and food sectors. As of current market evaluations, shares are trading around $15, a stark contrast to their initial public offering (IPO) price of $25 in 2019.

Recent Developments

In recent months, Beyond Meat faced a substantial dip due to disappointing quarterly earnings. The company reported lower-than-expected revenue, alongside news of increasing competition in the plant-based sector from both new entrants and established food companies diversifying their offerings. Despite these challenges, Beyond Meat’s management has reaffirmed its commitment to expanding production capacity and product lines, which they believe will drive long-term growth.

Additionally, collaborations with major fast-food chains have generated a buzz, as Beyond Meat continues to innovate with product offerings aimed at meat-lovers seeking alternatives without compromising on taste. These partnerships are crucial for boosting sales, especially in tough economic environments.

Investor Sentiment and Future Outlook

The overall sentiment around Beyond Meat shares resembles cautious optimism. Analysts suggest that while immediate challenges may persist, the long-term outlook remains positive, driven by increasing consumer demand for plant-based products, particularly as health and environmental awareness rises. Projections indicate that the share price could see recovery if the company successfully capitalizes on its growth strategies and stabilizes its financial performance.

Conclusion

For investors tracking Beyond Meat share price, keeping an eye on market trends, consumer behaviour shifts, and the company’s strategic decisions will be vital. As the plant-based industry continues to evolve, Beyond Meat’s balance sheet performance and adaptability to market demands could fundamentally shape its share price trajectory in the coming years. Continued monitoring of their financial results and announcements will be key to understanding the potential upswing or further declines in their stock value.