BT Share Price: Current Performance and Investment Outlook for Britain’s Telecom Giant

Understanding BT’s Share Price Movements

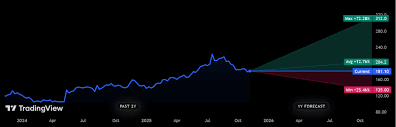

The BT Group share price remains a focal point for investors monitoring Britain’s telecommunications sector. As the UK’s largest provider of fixed-line, broadband and mobile services, BT’s stock performance reflects both the company’s operational transformation and broader market conditions. Recent market data shows the share price has experienced volatility, with analysts debating whether current valuations represent opportunity or risk for investors.

Recent Financial Performance and Strategic Progress

BT’s ongoing modernisation continues at pace, delivering a further step-up in fibre build and take-up, customer satisfaction and EBITDA, according to Chief Executive Allison Kirkby’s recent statement. The company has achieved significant infrastructure milestones, with record FTTP build rate of over 1m premises passed in the quarter for a fourth consecutive quarter; FTTP footprint reached 17m premises, more than half of the UK.

The telecommunications giant’s strategic focus on network expansion and digital transformation appears to be gaining traction. Record customer demand for Openreach FTTP with net adds of 472k in the quarter demonstrates growing appetite for the company’s upgraded services, potentially supporting future revenue growth and shareholder value.

Market Outlook and Investment Considerations

Investor sentiment around BT shares reflects competing narratives. While the stock has faced headwinds, with 15% annual earnings growth forecast, some analysts question whether current pricing offers value. The company’s extensive operations across around 180 countries provide diversification, though domestic market performance remains crucial.

For investors evaluating BT’s share price, several factors warrant attention: the company’s infrastructure investment programme, competitive pressures in the UK market, and management’s ability to deliver on transformation promises. The Board has approved a final dividend for FY25 of 5.76p, demonstrating commitment to shareholder returns alongside strategic investment.

Significance for Investors

BT’s share price trajectory matters beyond individual portfolios—it serves as a barometer for Britain’s telecommunications sector and infrastructure investment climate. As the company continues its fibre rollout and navigates evolving market dynamics, share price performance will likely reflect execution on strategic priorities and broader economic conditions affecting UK equities.