BAE Share Price: Defence Giant Consolidates After Record-Breaking Rally

Introduction: Why BAE Share Price Matters Now

BAE Systems plc, Europe’s largest defence contractor, remains at the centre of investor attention in December 2025. The stock is trading around 1,705p in London, having opened near 1,701p and traded in a tight 1,700–1,716p range, roughly 1–1.2% lower on the day, reflecting modest consolidation after a strong run. With year-to-date total returns of roughly 44–46%, including dividends, and five-year total returns over 210%, the BAE share price has become a key bellwether for the broader defence sector and geopolitical risk.

Current Share Price Performance

The London listing is trading just under 1,700p per share, with recent real-time quotes around 1,690–1,700p. The shares sit in a 52-week range of roughly 1,127.5p to 2,071p, so the current level is around 20% below the early-October peak but still far above last year’s lows. Despite the recent pullback from highs, BAE shares have risen by roughly 40% over the last 12 months, significantly outperforming many wider equity benchmarks and the broader defence sector.

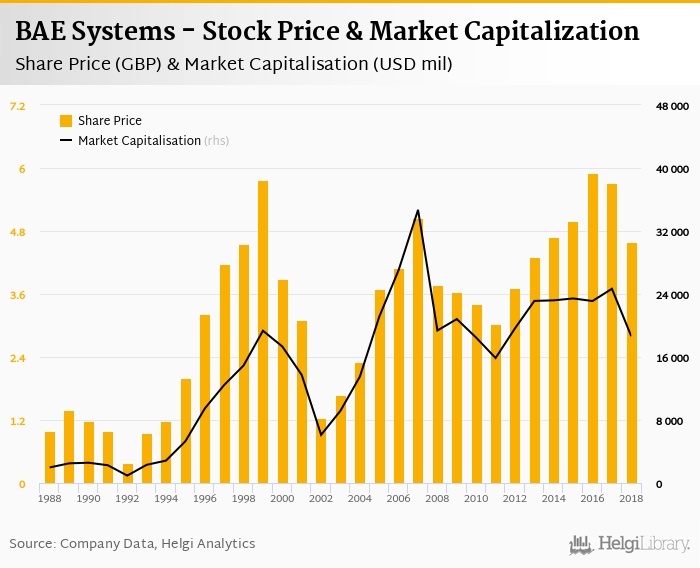

Market capitalisation stands at about £50 billion, and the stock trades on a price/earnings ratio near 25–26x, implying that investors are paying up for growth visibility and defence exposure.

New Contracts Underpin Growth Story

The recent news flow has been dominated by a steady stream of defence contracts. BAE Systems secured a contract modification worth more than $390 million to produce additional Bradley A4 infantry fighting vehicles for the U.S. Army. The funding supports the Army’s multi-year effort to replace legacy Bradleys with the upgraded A4 configuration, which offers improved mobility, lethality and crew protection, with initial deliveries under this latest phase due by October 2026.

In early December, BAE unveiled Velhawk, a cybersecurity framework that fuses artificial intelligence, automation and adaptive analytics into a unified architecture designed to detect and neutralise threats faster than human operators can react. It aims to reduce response times and staffing requirements for large government and critical-infrastructure customers. Three Azalea radio-frequency satellites designed and built by the company have been successfully launched via Exolaunch as part of a new multi-satellite constellation.

Analyst Outlook and Dividend Prospects

The analyst community remains broadly bullish, with most 12-month price targets clustered in the 2,000–2,150p range, implying 20–30% upside from current levels. Based on data from MarketBeat, the company has an average rating of “Moderate Buy” and an average target price of GBX 1,996.75.

For income investors, the interim dividend for 2025 was 13.5p, paid on 3 December 2025, a 9% increase on the prior interim. Based on current guidance and declarations, total 2025 dividend per share is around 34.1p. At a share price just under 1,700p, that equates to a forward dividend yield of roughly 2%.

Conclusion: What Investors Should Watch

Fundamentals show double-digit order growth, a record £78.3 billion backlog, robust cash generation and an upgraded A-credit rating point to a business with unusually high visibility into 2026 and beyond. Management is pushing deeper into cyber, AI, synthetic training and space-based sensing. The stock has de-rated from its peak but still trades on a premium multiple, with consensus targeting roughly 20–25% upside over the next 12 months.

Looking ahead, the BAE share price will remain sensitive to geopolitical developments, programme execution and valuation concerns. At roughly 25–26x trailing earnings, the stock is priced for continued strong growth. Any disappointment on guidance, cash generation or political newsflow could trigger multiple compression, even if the long-term story remains intact. For long-term investors, BAE Systems continues to offer exposure to a multi-year defence spending cycle, underpinned by one of the strongest order books in the sector.