Winter Fuel Payment: who is eligible and what it covers

Introduction

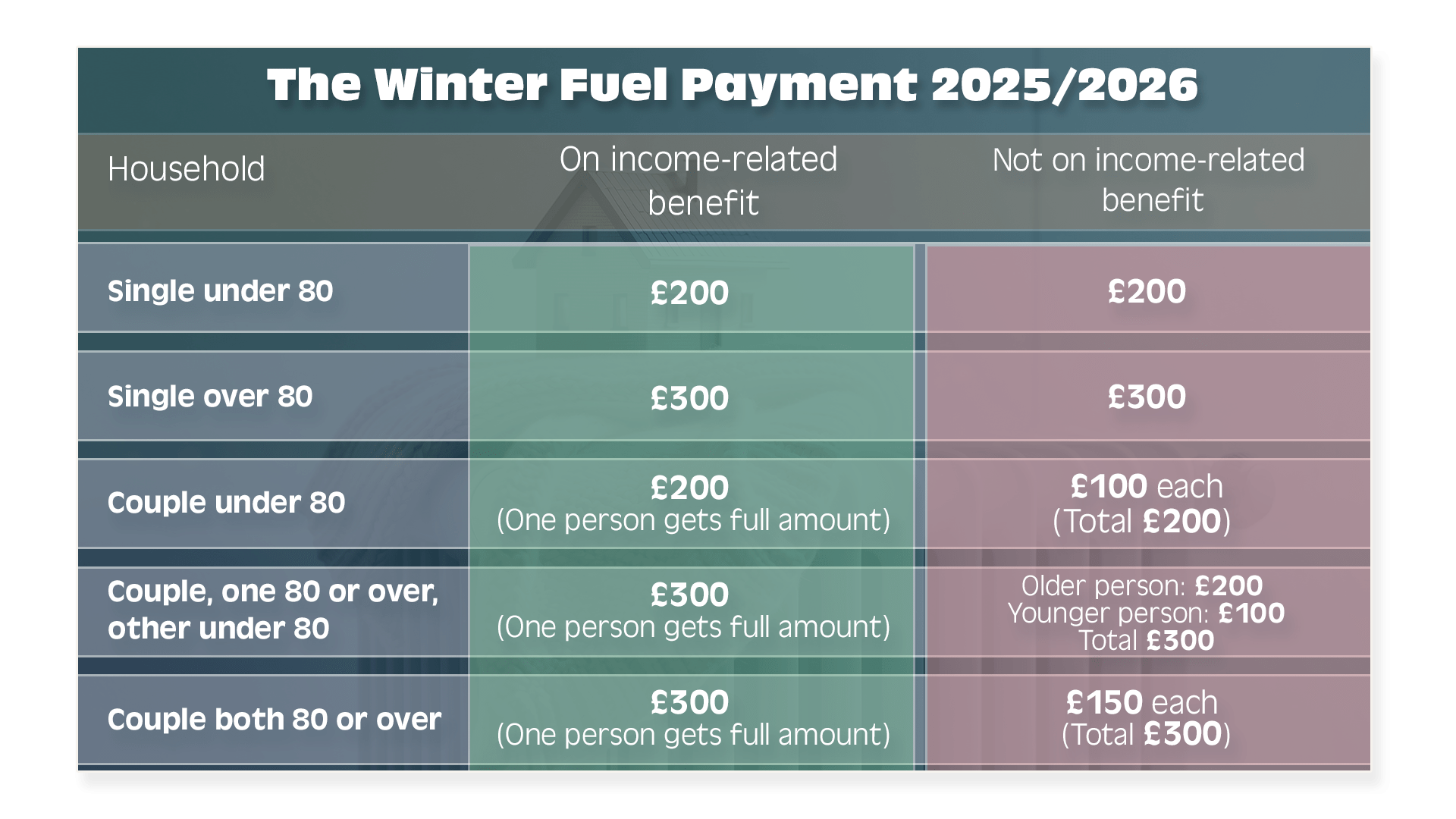

The winter fuel payment is an important state benefit designed to help older households meet the extra cost of heating during the colder months. As energy costs and cold weather continue to affect household budgets, understanding who qualifies and what the payment covers is relevant for many people approaching or at State Pension age.

Main details

What the winter fuel payment is

The winter fuel payment is paid as an annual, tax‑free lump sum. It is intended to help with additional heating costs over the winter period. Official sources describe it as a one‑off, tax‑free payment made during winter to assist households with heating expenses.

Eligibility

Eligibility centres on age. To receive the winter fuel payment, an individual must have reached State Pension age. Guidance from charities and official summaries indicates the payment is made to households that include someone of State Pension age. The scheme is established as a state benefit and is noted in published references for areas including England and Wales.

Purpose and timing

The purpose of the payment is to offset the higher fuel costs that come with colder weather. Providers and information sources consistently describe it as an annual payment, paid once each winter season as a lump sum and exempt from income tax. The timing is aligned with the winter period to coincide with peak heating needs.

Conclusion

The winter fuel payment remains a targeted form of state support for older people and households that include someone at State Pension age, offering a tax‑free, annual lump sum to help with winter heating costs. For readers approaching State Pension age or supporting older family members, the payment can ease seasonal energy bills. As energy costs and winter conditions evolve, the payment continues to be a relevant element of the social security framework for eligible households.