IAG Share Price Soars: What Investors Need to Know in 2026

IAG Share Price Shows Remarkable Momentum

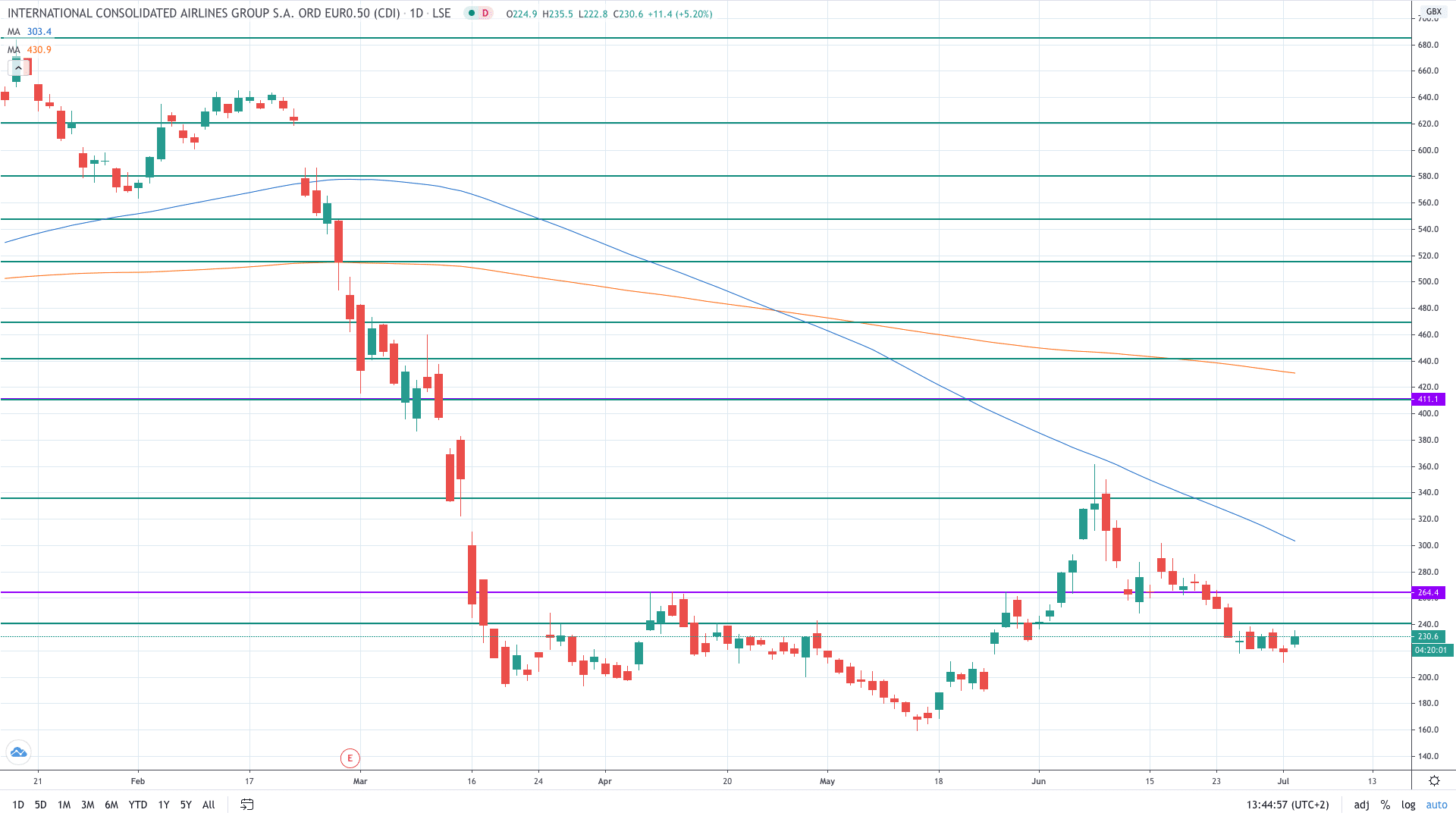

The International Consolidated Airlines share price today is 411.28p, reflecting a 0.34% change over the last 24 hours and -3.15% over the past week. The airline holding company, which owns British Airways, Iberia, Vueling, and Aer Lingus, has emerged as one of the standout performers in the UK market. 2025 was a brilliant year for the International Consolidated Airlines share price, with the stock rising more than 35% over the course of the year.

Strong Financial Performance Drives Investor Confidence

Throughout 2025, the airline operator consistently delivered good results as consumers continued to spend money on travel. For the first nine months of the year, the group reported an operating profit of €3.9bn, an 18% year-on-year increase. The company has also made significant progress in strengthening its balance sheet. At the end of Q3, net debt stood at 0.8 times EBITDA, down from 1.1 times a year earlier. Debt had been a major drag on the IAG share price so investors cheered the company’s aggressive focus on cleaning up its balance sheet.

Analyst Forecasts Point to Continued Growth

Looking ahead to 2026, market sentiment remains positive. Analysts expect the company to continue performing, with revenue rising about 4% and earnings per share climbing about 7%. The average price target is 487p, which is about 18% higher than the current share price. Bernstein analyst Alex Irving believes European airlines face a supportive backdrop heading into winter, with IAG best positioned to outperform into 2026 due to its high North Atlantic exposure and London-US capacity tightness.

What This Means for Investors

Adding in the dividend yield of 2%-3%, investors could be looking at returns of around 20% this year, which is most likely higher than the return the market as a whole will generate. The price-to-earnings ratio as we start 2026 is only about 6.5 on a forward-looking basis, meaning the shares still look pretty cheap. The company’s improved financial position, combined with strong demand for air travel and strategic growth opportunities, positions IAG favourably for continued success in 2026.