RR Share Price: Rolls‑Royce and Richtech Robotics Update

Why the rr share price matters

The phrase “rr share price” can refer to different listed companies depending on the exchange, but it remains a frequent search for investors tracking either Rolls‑Royce or firms using the RR ticker. Share prices offer a quick gauge of market sentiment and short‑term moves, so clear, up‑to‑date information is important for decisions on buying, selling or monitoring holdings.

Relevance for readers

For retail and institutional investors, knowing which RR listing is being referenced — the Rolls‑Royce group on UK markets or a US‑listed company using the RR ticker — is essential to avoid confusion and to interpret price moves correctly.

Main update: current quoted prices

Rolls‑Royce (UK listing)

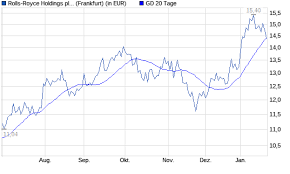

Two publicly available snapshots report the UK share price for Rolls‑Royce. London South East’s share chat shows a quoted price of 1,244.00 (with a 0.00 change, 0.00%), noting that the figure is delayed by 15 minutes. Separately, eToro lists Rolls‑Royce RR.L at 1,242.1340 pence. These figures are closely aligned, indicating a mid‑1,200 pence range in the available snapshots.

Richtech Robotics (NASDAQ: RR)

On US markets, TradingView lists NASDAQ:RR as Richtech Robotics Inc. and quotes a current price of $4.55 USD. That price reflects a notable short‑term move, up 12.95% over the past 24 hours. This rise highlights short‑term momentum for the Nasdag RR listing in the latest available data.

Conclusion: what this means for investors

Investors tracking the “rr share price” should first confirm which company and exchange they intend to follow. The supplied snapshots show Rolls‑Royce trading around 1,242–1,244 pence in delayed quotes, while Richtech Robotics on NASDAQ is quoted at $4.55 with a significant one‑day gain. Given differing instruments and market hours, readers should consult live feeds or their trading platform for real‑time prices and consider the 15‑minute delay noted in some sources. Short‑term movement such as the 12.95% rise for NASDAQ:RR may signal momentum but also warrants further verification and broader context before investment decisions are made.