Gifts Gone Wrong: Understanding Inheritance Tax Implications

Importance of Understanding Inheritance Tax

Inheritance tax is a significant consideration for individuals planning their estates, particularly when it comes to gifting assets. As people increasingly seek to pass wealth to the next generation, understanding the potential pitfalls and implications of inheritance tax on gifts is essential to avoid financial burdens on beneficiaries.

What is Inheritance Tax?

Inheritance tax is a form of tax levied on the estate of a deceased person. In the United Kingdom, estates valued over £325,000 may be subject to this tax at a rate of 40% on the portion exceeding this threshold. However, gifting assets while still alive can also trigger tax implications, especially if the transfer of assets is not managed correctly.

How Gifts Can Complicate Matters

When individuals give away gifts, particularly those above the annual exemption limit (£3,000 per donor per tax year), they enter a territory that can lead to complex tax issues. If the giver passes away within seven years of making a gift, that gift may still be included in their estate for inheritance tax purposes, potentially increasing the tax liability.

For instance, someone who gifts a property or a significant sum of money without considering the inheritance tax could inadvertently leave their heirs with a hefty tax bill, diminishing the value of the gift. Moreover, if the recipient sells the gifted asset, they may also face capital gains tax, compounding the financial burden further.

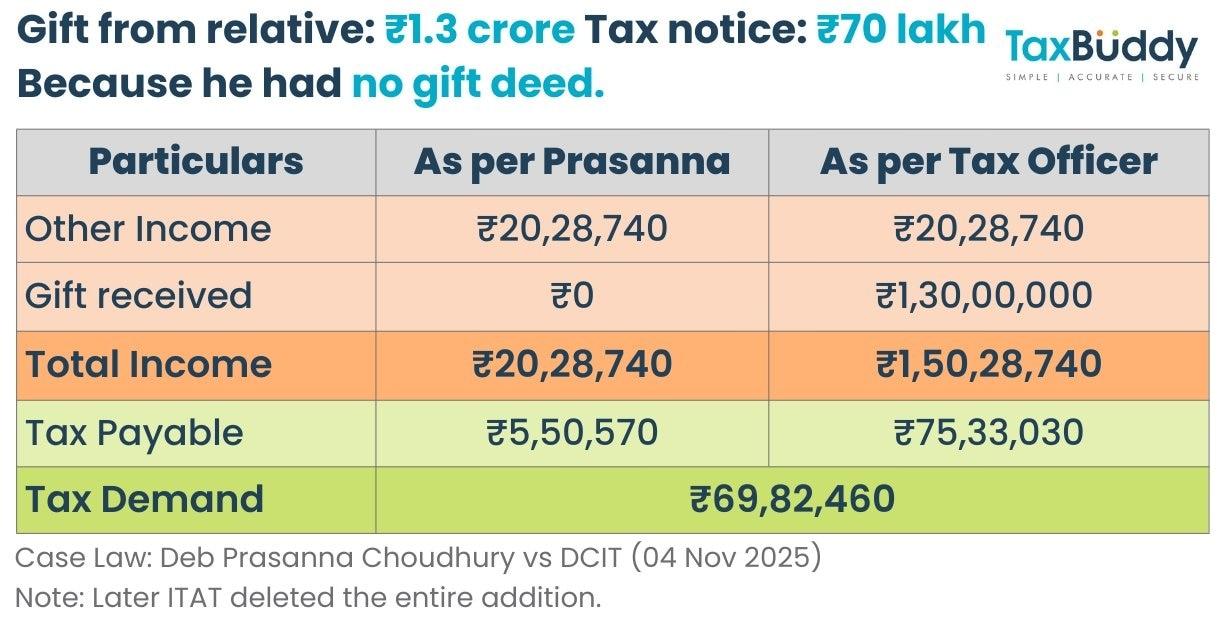

Case Examples and Recent Trends

Recent reports indicate a growing number of disputes arising from improper handling of gifts and inheritance tax planning. Families often find themselves at odds over the valuation of gifts, especially if their worth appreciates over time. Legal challenges can ensue regarding what constitutes a gift and its tax implications, leading to stress and division among loved ones.

Conclusion: Seeking Professional Guidance

The significance of understanding the implications of gifts within inheritance tax cannot be overstated. As individuals seek to build legacies for their families, it is imperative to approach gifting with a well-informed strategy. Consulting with financial advisors or estate planners can lead to better decision-making, ensuring that your gifts do not inadvertently become a burden for your beneficiaries. Planning ahead can not only save families financial strain but also preserve harmony in relationships during what can be a difficult time.