HMRC Tax-Free Allowance: Understanding Your Personal Allowance for 2025/26

Why the HMRC Tax-Free Allowance Matters

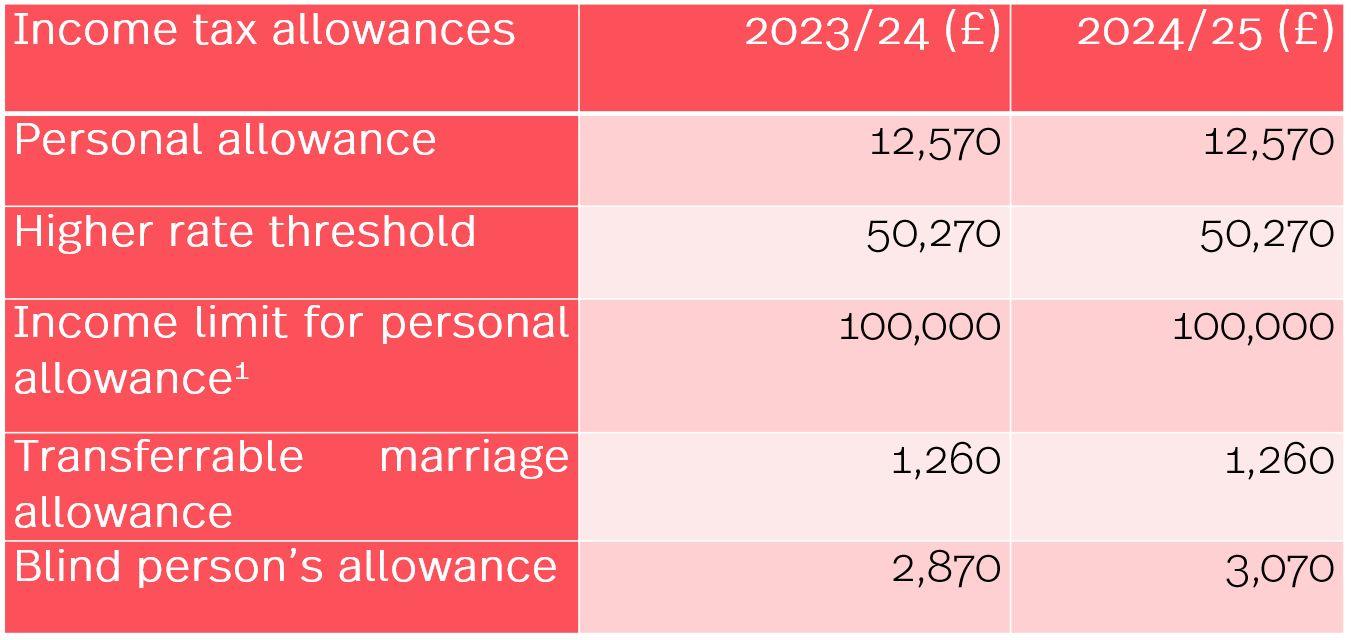

The HMRC tax-free personal allowance is a fundamental component of the UK tax system, determining how much you can earn before paying income tax. For 2025/26, the personal allowance remains frozen at £12,570, a figure that has significant implications for millions of taxpayers across England, Wales, and Northern Ireland.

Understanding your tax-free allowance is crucial for effective financial planning. The standard tax code 1257L reflects this personal allowance of £12,570, which your employer or pension provider uses to calculate how much tax to deduct from your income.

Current Tax-Free Allowance Details

Most individuals can claim a personal allowance, unless their income exceeds £125,140. This threshold is particularly important for higher earners to understand, as those earning over £100,000 will see their personal allowance reduced by £1 for every £2 that their income exceeds £100,000.

The personal allowance and certain tax thresholds have been frozen until April 2028, as confirmed in the Autumn Budget 2024. This freeze means that as wages increase with inflation, more people are likely to be pushed into higher tax brackets—a phenomenon known as fiscal drag.

What This Means for Taxpayers

Once you exceed the £12,570 tax-free threshold, income tax rates apply progressively. A basic rate of 20% applies on earnings between £12,571 and £50,270, a higher rate of 40% on earnings between £50,271 and £125,139, and an additional rate of 45% on earnings exceeding £125,140.

The frozen allowances have real-world consequences. As more individuals see pay rises, they may find themselves paying more tax without receiving any increase in their take-home purchasing power. This is especially relevant for those approaching the £100,000 threshold, where the effective tax rate can exceed 60% due to the tapered allowance.

Planning Ahead

With the tax-free allowance remaining unchanged until at least 2028, taxpayers should consider reviewing their financial strategies. Maximising tax-efficient savings and investments, such as ISAs and pensions, becomes increasingly important. It’s also wise to ensure your tax code is correct, as errors can result in overpayment or underpayment of tax throughout the year.