Stealth Tax: The Hidden Burden Facing British Taxpayers in 2026

Understanding Stealth Tax in the UK

A stealth tax is a tax levied in a way that is largely unnoticed, or not recognized as a traditional tax. As Britain enters 2026, millions of taxpayers continue to feel the impact of these hidden levies, particularly through frozen tax thresholds that quietly increase the tax burden without any official rate rises being announced.

A stealth tax is considered to be a mechanism for raising revenue for the exchequer in a way that’s not explicitly made clear to taxpayers. Freezing income tax thresholds does indeed provide more funds for the government, but it’s controversial because it can lead to people paying more tax despite no official tax rise being announced.

The Current State of Stealth Taxation

The most significant stealth tax currently affecting British households is the freeze on income tax thresholds. In the 2022 Autumn Statement, then Chancellor Jeremy Hunt announced the freeze of the income tax personal allowance and higher rate threshold, as well as the NICs thresholds, would be extended to April 2028 instead of ending in 2026. At the Autumn 2024 Budget, Chancellor Rachel Reeves announced the government would not extend the freeze to income tax thresholds beyond April 2028.

This policy creates what economists call “fiscal drag,” where more taxpayers are ‘dragged’ into paying tax, or into paying tax at a higher rate. In 2025, with inflation lingering and wages not always keeping pace, these taxes hit the average family to the tune of over £10,000 a year, according to recent Institute for Fiscal Studies (IFS) estimates.

The Financial Impact on British Households

The consequences of stealth taxation are far-reaching and substantial. The Labour government’s plans to maintain the income tax threshold freezes introduced by the Conservatives mean that an estimated additional 1.9 million people will be hit, forcing them to shell out close to an estimated £9 billion in additional tax receipts by the end of the decade. The impact means that between 2025/26 and 2029/30 an estimated 1.9 million people will be forced to pay a higher rate of tax due to these threshold freezes. It means for those millions impacted, they will be forced to shell out an estimated £8.9 billion in additional tax as a result of the freezes by the end of the decade.

For 2025/26, the average Band D bill in England is £2,180, up 5% from last year in many areas. Council tax, VAT, National Insurance contributions, and other indirect taxes all contribute to the overall stealth tax burden that British families face daily.

What This Means for Taxpayers

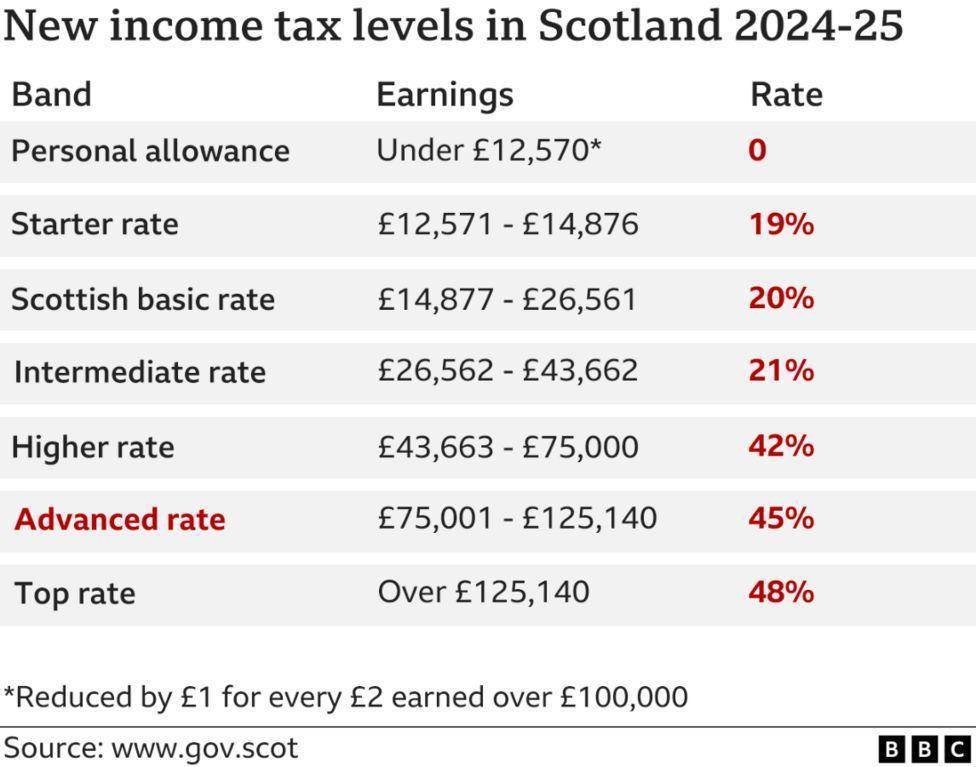

The implications of stealth taxation extend beyond simple income tax. According to Steve Webb, former Pensions Minister, the number of pensioners now paying income tax at the higher (40%) or additional (45%) rates has more than doubled in just four years. Meanwhile, in the 2023/24 tax year, an estimated 1.9 million people paid tax on their savings interest, up from 1.77 million the year before and just 970,000 in 2021/22. According to HMRC the amount raised from tax on savings interest surged to a record £9.1 billion.

As we move through 2026, understanding stealth taxes becomes increasingly important for household financial planning. While tax rates remain nominally unchanged, the real-world impact on British families continues to grow, making it essential for taxpayers to stay informed about how these hidden levies affect their finances and to seek professional advice where necessary to mitigate their impact.