A Comprehensive Guide to Stocks and Shares ISA

Introduction

Stocks and Shares Individual Savings Accounts (ISAs) have become a cornerstone for UK investors looking to grow their wealth while enjoying tax benefits. As traditional savings accounts yield lower returns in the current economic climate, the importance of understanding stocks and shares ISAs cannot be overstated. This investment vehicle allows individuals to invest in a diversified array of assets, including shares, bonds, and funds, all while shielding returns from tax.

What is a Stocks and Shares ISA?

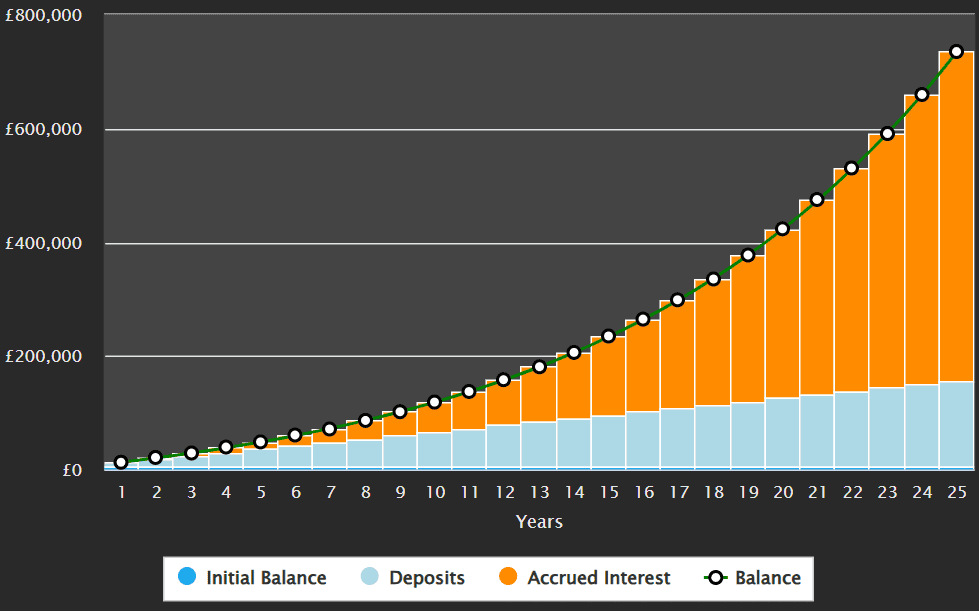

A Stocks and Shares ISA is a type of Individual Savings Account that lets you invest your money in stocks, shares, and other investment vehicles without having to pay capital gains tax or income tax on any returns. Each tax year, individuals can invest up to a set limit—in the 2023/24 tax year, this limit is £20,000. This means that returns on investments made within an ISA can potentially grow significantly over time.

Benefits of Stocks and Shares ISA

The primary allure of a stocks and shares ISA is the tax efficiency it offers. Capital gains and dividend income are exempt from taxation, allowing for enhanced growth when compared to more traditional saving methods. Furthermore, investors have the flexibility to diversify their portfolios with different asset classes that can adjust according to their risk appetite.

Current Trends and Events

In recent news, the ISA market has seen an uptick in interest, especially among younger investors. Data from HM Revenue & Customs indicates that the number of stocks and shares ISAs opened by under-40s has risen sharply, attributed to an increased awareness of investing and financial literacy driven by digital platforms. With the ongoing uncertainty surrounding global markets, many are seeking safe yet fruitful methods to secure their financial futures.

Conclusion

As stocks and shares ISAs continue to rise in popularity, they present an appealing option for both seasoned investors and beginners looking to maximize their savings. The combination of tax benefits and potential for higher returns makes them a compelling choice in a time of financial volatility. For anyone interested in investing, understanding the features and benefits of a stocks and shares ISA is crucial to building a successful investment strategy. Long-term financial growth remains attainable, especially for those who start investing early and remain informed about market trends.