Analyzing the Current Barclays Share Price

Importance of Barclays Share Price

The share price of Barclays PLC is a significant indicator of the health of the UK banking sector and serves as a barometer for investor confidence in the financial markets. With ongoing economic developments, fluctuations in the share price are closely monitored by analysts and investors alike, making it a crucial topic in today’s investment landscape.

Current Trends and Recent Performance

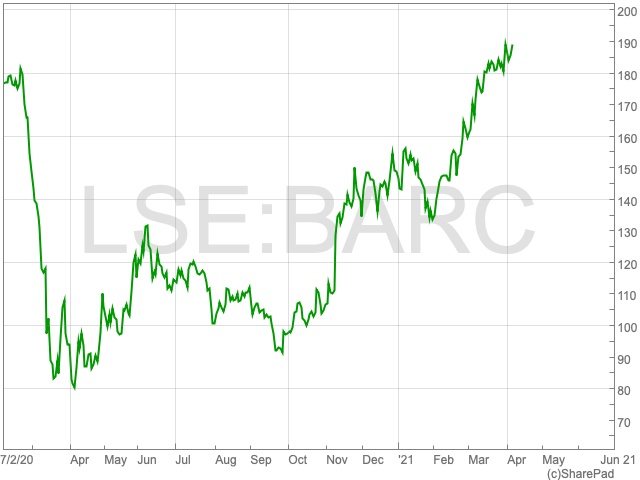

As of October 2023, Barclays share price has seen notable fluctuations, reflecting broader market trends and internal financial performance. Following a steady increase earlier in the year, the share price experienced a dip in August, attributed primarily to rising interest rates and a more cautious outlook from central banks. Analysts report that as of the latest market close, Barclays shares were priced at approximately £1.90, showing a slight recovery from the lows of £1.75.

Market interventions, including the Bank of England’s decision to maintain interest rates, have provided some support to the banking stocks, but uncertainty remains as investors evaluate the potential impacts of economic indicators like inflation and consumer spending. In this environment, Barclays is also focusing on its digital transformation strategy, which aims to enhance operational efficiency and reduce costs, further influencing investor sentiment.

Factors Influencing Barclays Share Price

Several factors are currently influencing Barclays share price. First, the global economic climate continues to shift as various geopolitical tensions and market volatility affect investor behaviour. Second, the performance of financial technology companies poses both threats and opportunities for traditional banks like Barclays, where innovation and customer engagement are critical for retaining market share.

Moreover, Barclays’ recent quarterly earnings report showcased a strong increase in net profit compared to the previous year, giving investors some optimism. Despite this, analysts remain cautious, highlighting the potential risks associated with high inflation rates and reduced consumer confidence.

Conclusion and Future Outlook

The Barclays share price is expected to remain volatile as the market reacts to economic developments and corporate performance updates. Investors are advised to keep a close watch on upcoming financial reports and analyst recommendations, as these will provide further clarity regarding the company’s direction and market health. In the short term, Barclays may experience fluctuations, but long-term projections remain optimistic provided the bank successfully adapts to the ever-evolving financial landscape and continues its growth trajectory.