Analyzing the Current Trends in Intel Stock

Introduction

Intel Corporation is one of the world’s leading technology companies, renowned for its semiconductor products and technology solutions. Understanding the performance of Intel stock is crucial for investors and analysts alike, especially given the company’s pivotal role in the tech industry. With the stock market constantly fluctuating, staying informed about Intel’s financial health and market strategies has never been more important.

Current Stock Performance

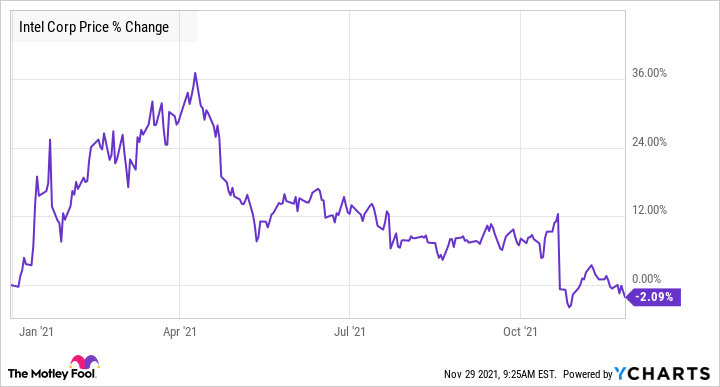

As of October 2023, Intel’s stock is displaying a mixed performance. The stock opened at $30.45, fluctuating within a range between $28.00 and $32.50 over the last month. Investor sentiment has been largely influenced by Intel’s recent quarterly earnings report which showed a year-on-year decline in revenue mainly due to supply chain issues and increasing competition in the semiconductor market.

Intel’s stock has faced downward pressure due to several factors, including market volatility and challenges in meeting production demands. However, the company’s strategic shifts, including investments in new technology and partnerships, are being closely monitored by analysts.

Recent Developments

Intel has announced several significant developments recently that may impact stock performance moving forward. The company has committed to investing $20 billion in new manufacturing facilities in the US, aiming to bolster its production capabilities and regain market share from competitors like AMD and NVIDIA. This move is part of a broader strategy to enhance its competitive edge and bring more manufacturing back to domestic soil.

Furthermore, Intel is also focusing on research in artificial intelligence and data centre markets, sectors that promise substantial growth potential. This diversification could provide a positive outlook for Intel stock in the long run, as it positions the company to adapt to evolving technology trends.

Conclusion

In conclusion, while Intel stock is currently navigating challenges related to competition and production bottlenecks, the company is implementing strategies that could foster growth and recovery. Investors should consider the long-term potential of Intel amidst its ongoing transformations. Market analysts predict that if Intel successfully executes its plans for expansion and innovation, it could see a rebound in stock performance. As always, potential investors should continuously monitor market conditions and company announcements to make informed decisions.