Bank of England Base Rate Poised for December Cut as Inflation Eases

Introduction: A Critical Moment for UK Monetary Policy

The Bank of England stands at a pivotal juncture as markets anticipate a crucial interest rate decision on 18 December 2025. Traders’ bets imply a 98% chance the Monetary Policy Committee will lower the base rate to 3.75% from 4%, a move that would significantly impact millions of borrowers and savers across the United Kingdom. This anticipated cut comes as UK inflation fell by more than economists had expected in November to 3.2%, down from 3.6% in October, strengthening the case for monetary easing.

Recent Rate Trajectory and Current Economic Climate

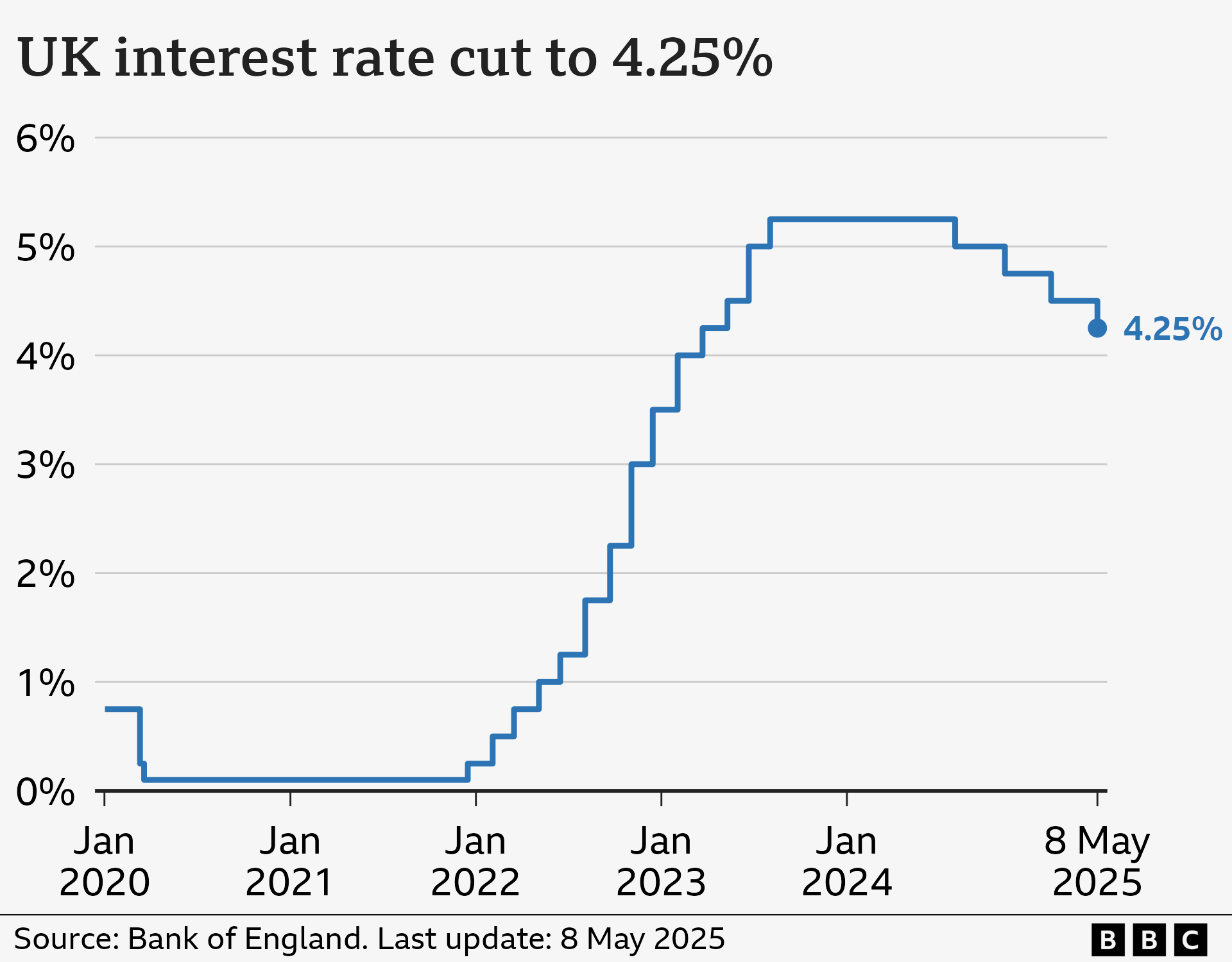

The Bank held interest rates at 4%, having been able to cut rates five times since August last year. The November meeting saw a tight vote, with five members in favour of no change and four in favour of cutting rates by 0.25 percentage point. Governor Andrew Bailey has indicated flexibility, with Bailey prepared to loosen policy if incoming data continued to point toward falling inflation.

The encouraging inflation data has provided policymakers with the breathing room they needed. The annual inflation rate in the UK slowed to 3.2% in November 2025, the lowest in eight months, exceeding both Bank of England forecasts and market expectations. This represents substantial progress from the peak of 11.1% reached in October 2022, though inflation remains above the Bank’s 2% target.

Implications for Borrowers, Savers and the Economy

The expected rate cut carries significant implications for households and businesses. A rate cut would be ‘festive news for borrowers of all stripes’, potentially leading to lower mortgage rates for homeowners. However, savers may see returns diminish as banks adjust their deposit rates downward. This would take borrowing costs to their lowest level since early 2023.

Looking ahead, experts expect two further reductions in 2026, in March and June, which would take the base rate down to 3.25%. This gradual approach reflects the Monetary Policy Committee’s cautious strategy of balancing inflation control with supporting economic growth. The Bank has balanced the risk that above-target inflation becomes more persistent against the risk that demand in the economy is weakening.

Conclusion: Cautious Optimism Amid Uncertainty

The anticipated December rate cut represents a careful calibration of monetary policy in response to improving inflation dynamics. While the decision appears likely, the Bank believes inflation has peaked and will fall, and if inflation stays on track, it should be able to gradually reduce interest rates further, though it can’t say precisely when or by how much, as that depends on how things evolve. For UK households and businesses, the coming months will be crucial in determining whether this marks the beginning of a sustained period of lower borrowing costs or merely a temporary reprieve in the ongoing battle against inflation.